12 September 2025

Go higher? How to perform even better...

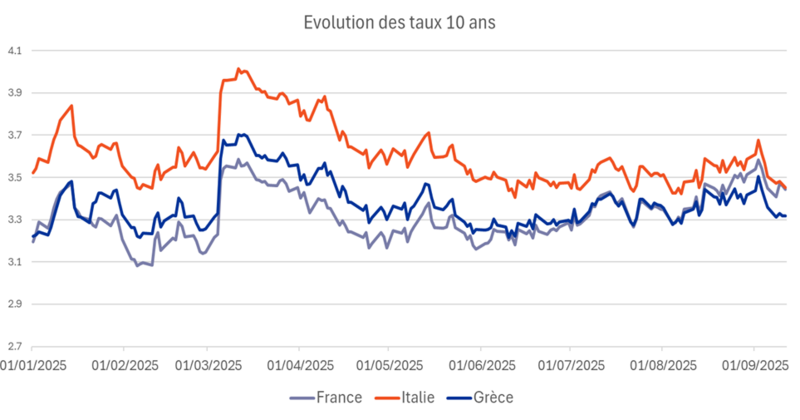

« France joins Eurozone’s ‘periphery’ as turmoil deepens » headlined the Financial Times the day after François Bayrou's government fell, with the country's borrowing rates exceeding those of Italy and Greece (see chart below).

Sources : Bloomberg, Amplegest

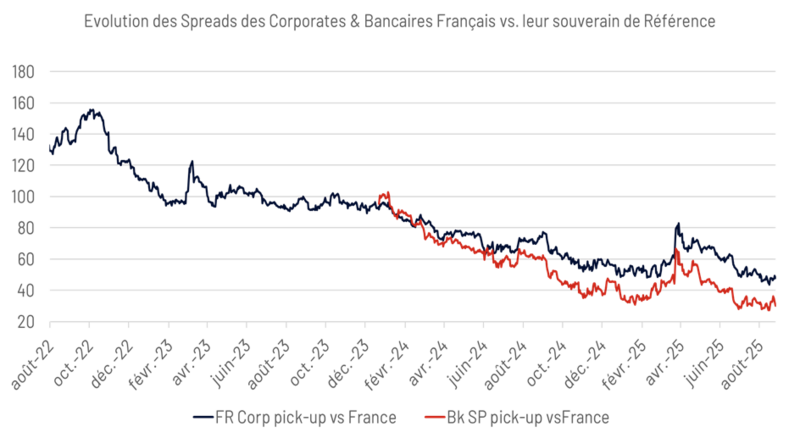

Our readers can rest assured that this hebdo crédit will not be yet another commentary on our country's political and economic drift. However, this latest twist in events provides a perfect illustration of the central theme of our seasonal presentation held at Le Bristol on 10 September. While French sovereign spreads reached new highs, French corporate and financial spreads were barely affected by the ongoing political drama (see chart below). This, despite the fact that financial institutions are structurally linked to their sovereign and that their financial statements will suffer from the financial impact of this political and economic reality.

Sources : IHS Markit, Natixis, Amplegest

The situation is the same everywhere and is perfectly reflected in the performance of each segment of the credit asset class since the beginning of 2025. Interest rates have crystallised all the doubts and concerns of the markets since the beginning of the year, with credit spreads continuing to tighten until recently reaching historic lows in certain risk categories or segments – even though they are supposed to compensate investors for the additional risk they take by positioning themselves on a specific private entity rather than a sovereign entity – or how sovereigns, victims of an increasingly widespread addiction to deficit(s) (in a recent interview, Gita Gopinath, Deputy Managing Director of the IMF, pointed out that public debt represented 92% of global GDP in 2024, compared with only 65% in 2000), seem to have lost their position as a ‘safe haven’. Above all, the global risk environment in which markets operate has undergone major upheavals in recent months.

Far be it from us to cry out about an impending cataclysm (Cassandra herself came to a bad end), but we cannot ignore the importance of these changes, most of which, without indulging in the cult of personality that the man himself is so fond of, are linked to the return of Donald Trump to the White House and his desire to follow in the footsteps of the 25th President of the United States, William McKinley, the “pope of protectionism”, and to use trade weapons ad nauseam in the conduct of his policy, raising the average level of customs duties on goods entering the United States to 17.4% for the time being. This paradigm shift has so far only caused a brief flicker of concern on the markets around the ill-named ‘Liberation Day’, with investors quickly finding plenty of arguments to justify their indifference to the event – from the signing of an ‘agreement’ (which in reality is nothing more than a vague memorandum) between President Trump and President Van der Leyen, to recent court rulings invalidating the legal basis for the ‘executive orders’ relating to 71% of these tariff increases (even though their invalidation by the Supreme Court itself would not mean their disappearance), to the argument that they are virtually harmless to the economic trajectory of the United States and, by extension, the global economy.

This final argument has been gradually invalidated, not only by all the signs of inflation across the Atlantic, but also by the slowdown in the labour market, as evidenced by the latest Non-Farm Payrolls figures for August – a slowdown largely attributable to the sectors most directly affected by the erection of the tariffs wall. These two factors, coupled with the negative effects of the tax reform sought by the US administration, point to growing pressure on household disposable income and are likely to cause a deviation from the US economic trajectory. These are hiccups in the « engine » of global growth that neither the eurozone, where sectoral (depending on the degree of openness and dependence on trade) and national disparities are likely to widen further, nor the Asian giants are likely to be able to compensate for.

Added to this initial set of risks, are those weighing on the clarity of monetary policy trajectories at a time when central bank independence is increasingly under attack (without, in defiance of history, causing any market turmoil) and the profound changes in global geopolitical balances induced by the radical shift in US foreign policy.

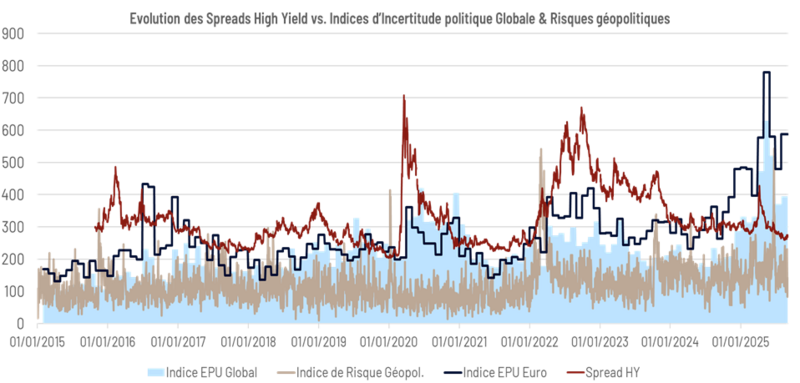

As the chart below perfectly summarises, while most economic and geopolitical uncertainty indicators point to a clear deterioration in the situation, credit spreads seem to be continuing unabated on their current trajectory.

Sources : Bloomberg, Amplegest

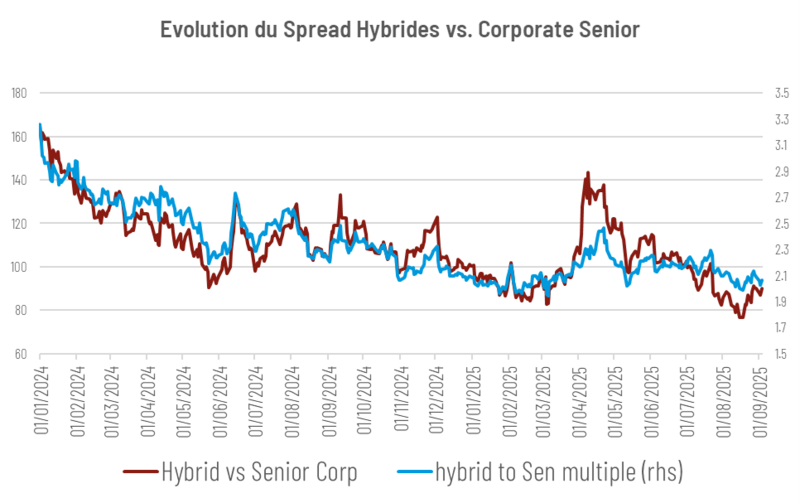

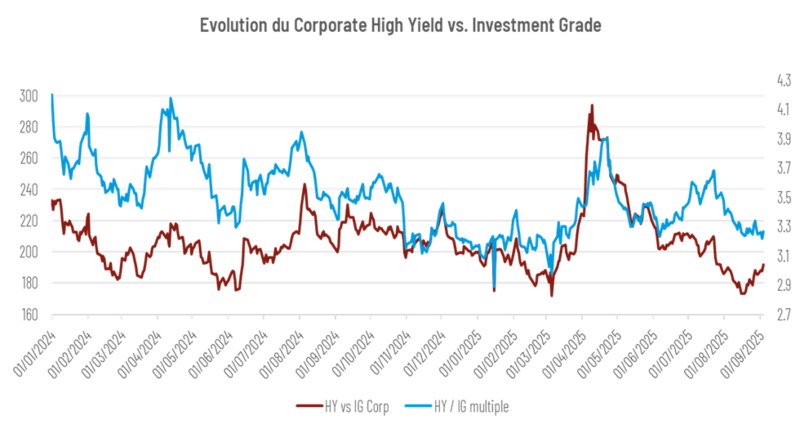

Although the explanation for this phenomenon is clear – it is due to the strength of capital inflows into the credit asset class, and there is no indication that this renewed interest in the asset class is likely to reverse quickly – particularly given the generally healthy fundamentals and yields that remain favourable compared to those offered by equities or real estate – we do not believe that this situation of widespread spread tightening is sustainable in the short to medium term. In other words, spread volatility is likely to soon add to the volatility that is now commonplace in rates. And the evolution of spreads since the end of the summer break – with the tentative signs of decompression that it highlights (see charts below) – seems to indicate that this ‘soon’ should be taken in the strictest sense.

Sources : IHS Markit, Natixis, Amplegest

Sources : IHS Markit, Natixis, Amplegest

Based on these convictions, we have positioned OCTO's flexible funds so that they can take advantage of all the opportunities that this renewed volatility is prone to create. True to our ‘value’ DNA, taking risks only when they are highly rewarded in relation to the fundamentals to which they relate, we have preserved our ability to deploy risk when such windows open, and we have kept derivative hedging in place (via iTraxx indices), considering that at current levels, the risk asymmetry was in our favour. This is all the more true given that the end of the year traditionally sees many fund managers entering into this type of contract in order to protect their performance.

While it is not certain, to refer to the title of our presentation, that the markets (at least via spreads) can go much higher, we believe that the performance potential of our funds remains intact at the dawn of the final quarter of the 2025 fiscal year.

Mathieu Cron