22 August 2025

A mild summer for credit markets

After its summer break, the Hebdo Crédit returns at the end of August with the observation that nothing disrupted investors’ holidays. A “gently sloping summer,” as movie buffs might say…

The first slope was in rates : European sovereign yields on intermediate and long maturities eased by 10 to 20 basis points, as shown by the French and German curves since July 1.

At the short end, expectations of further rate cuts—especially in the US—kept yields anchored. But the yield curve, which steepened sharply in the first half of the year, remains at its highest level since 2020 and could steepen further in the months ahead. Current forces—falling short-term rates versus upward pressure on long-term rates—are unlikely to abate, given widening budget deficits, rising debt, political tensions, and the gradual erosion of government credit quality.

Once again, the rise in long-term rates weighed on sovereign indexes, leaving them in negative territory over the summer. By contrast, credit-heavy indexes, thanks to shorter durations and stronger carry, continued to outperform. They were buoyed by hopes of a resolution to the war in Ukraine, a possible Fed rate cut in September, and a kind of “normalization” in the face of persistent instability in US trade negotiations with the rest of the world.

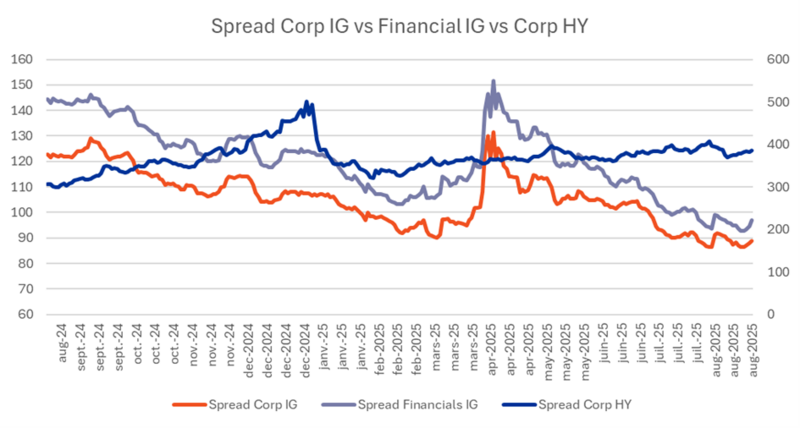

Like equities, credit spreads displayed remarkable resilience throughout these two months (see chart below).

Source : Markit

Source : Markit

As we head into the fall, we see no need for major changes to our portfolios—other than continuing to gradually extend duration in line with the rise in long-term rates, purely on a risk/return basis.

If we assume that “European risk” remains relatively contained—and ultimately capped by the ECB or the Fed, which would likely revert to the same tools successfully deployed in the 2010s during any major crisis—the risk/return profile of European and US duration has improved steadily in recent months. It now stands close to the levels seen at the end of 2023, which proved a very favorable entry point for positioning on long-term rates.

By contrast, equity and credit markets have already priced in Fed rate cuts starting in September, a truce in trade negotiations, and meaningful progress toward peace in Ukraine or the Middle East. The reality, however, may prove less straightforward as the summer break fades. In this context, we prefer to build duration—taking advantage of potential sudden moves—while avoiding any significant increase in credit risk, particularly in countries facing pressure on their credit quality, such as France.

The entire Octo Funds team hopes you enjoyed a great summer !

Matthieu Bailly