26 September 2025

RCI Bank breaks new ground by issuing an AT1... Well, not quite!

The global macroeconomic outlook appears to be holding steady. The OECD has just raised its 2025 growth forecast to 3.2% thanks to a fairly predictable combination of factors: frontloading in response to US tariffs, investment in AI and China's economic recovery. This will be enough to avoid a global recession, but not enough to dispel the impression that, as in the 2010s, trajectories are diverging: the United States is slowing down, but holding its own; Europe is running out of steam; France is lagging behind as usual.

It's almost a running gag: with every crisis, many analysts swear that US measures – in this case, Trump's tariff increases – will plunge the economy into recession. And every time, it is still the United States that comes out on top. US GDP will grow by 1.8% in 2025, less than in 2024 but better than feared, and above all with an unrivalled asset: the strength of the dollar. Europe, meanwhile, remains mired in its contradictions: imported inflation, weak growth and no room for manoeuvre in terms of budgetary policy. Once again, it is the most indebted and economically sluggish countries that are hardest hit by the turmoil.

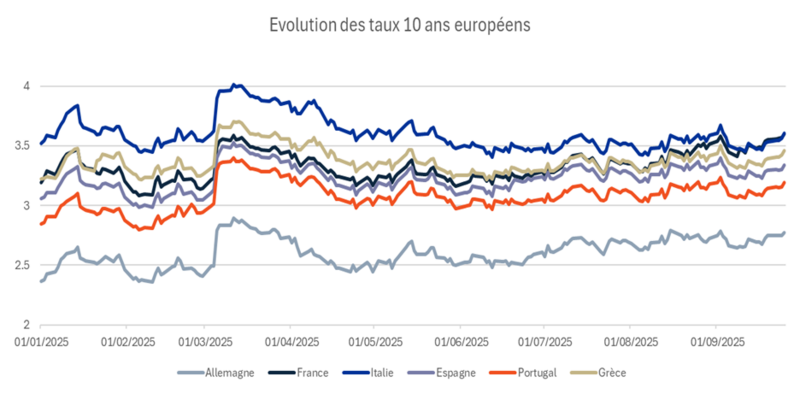

In this context, European credit continues to play its role as a safe haven, buoyed by stable or even rising medium/long-term rates (see chart below) and, although spreads remain tight, flows remain massive: investors want ‘safe’ returns and liquid assets because the environment is extremely volatile and many riskier or less liquid assets offer equivalent or lower returns... And they are rushing to the primary market. There is no shortage of examples: Capgemini raised €4 billion with an order book of €13 billion, Veolia placed an €850 million hybrid with an order book of €4.7 billion, and Valeo found €2.7 billion in demand for €500 million in green bonds... For once in this type of ‘green’ label, we note that Valeo is committed to ensuring that the funds are specifically dedicated to projects related to low-carbon mobility... Oversubscriptions are systematic and spectacular. The slightest issue premium offered at the outset disappears instantly, proof that the market is no longer just favourable to issuers: it is euphoric.

Sources : Bloomberg, Amplegest

And then there is RCI Bank. Renault's captive bank entered the AT1 market with a €400 million issue. The result: 7.4 billion in demand, or 18 times the amount offered. Why such enthusiasm? First, because the quest for yield is well and truly back, and this issue, with a yield of 6%, offers more than other AT1s and more than high yield, all this, with a reassuring name…

Secondly, and more importantly in our view, captive finance companies offer a very specific and reassuring credit profile: they lend when car sales are strong, i.e. when the economy is relatively favourable and households are solvent, and they reduce their exposure when the automotive sector is struggling, but do not have the massive and complex balance sheet risks of a traditional bank. Their structure is simple, and their balance sheets are generally stronger and more stable than those of their parent companies, especially since they are subject to the prudential ratios of banking regulators In short, they are everything creditors love. Historically, we have even seen higher ratings for captive banks than for the manufacturers themselves. And in the event of major stress, they know perfectly well, together with the regulator, how to find a new buyer or banking support – FIDIS, the Fiat subsidiary, which was partly taken over by Crédit Agricole a few years ago, is a perfect example.

While we particularly appreciate this type of issuer, we currently regret that the RCI issue combines a triple risk that we prefer to avoid at present – France + automotive + Tier 1 for a coupon of 6%, which we consider low...

RCI Bank's inaugural AT1 caused a sensation, but the innovation is relative: back in 1985, DIAC, thanks to Crédit Lyonnais, placed a perpetual participating bond (FR0000047821) with a floor of 6.5%, indexed to the TAM, which is still alive on the market, albeit with a residual outstanding amount of €15 million. Renault's captive finance companies had therefore already used perpetual debt nearly forty years ago — in a French legal framework — and although they were not ‘AT1’, we can nevertheless recognise their use as quasi-equity after so many years of service!

Conclusion: it's the same old story. The United States is performing better than expected, buoyed by its currency and economic power. Europe continues to struggle, weighed down by its debts and rigidities. Meanwhile, credit markets are intoxicated by yields and apparent security, to the point of oversubscribing ten or twenty times for issues that are not particularly attractive. In this environment, caution remains the order of the day: keep short durations, favour high-quality credit, and leave others with the illusion that the party can go on forever.

Matthieu Bailly