06 June 2025

When Worldline is out, Octo prefers to take cover...

While the ECB lowered its rates once again, to reach the famous 2% target expected by the consensus since it first raised them, the economic and financial situation has not become any clearer, and the institution has done no more than follow the data, as it had announced, to adjust more or less in line with the normalization of inflation and the fall in growth, while remaining moderately accommodating ; because the Eurozone is so slow, so clumsy and so penalized by its outrageous regulation in the face of the Chinese and American giants that it has always needed, for almost two decades now, lower rates to stimulate its economy and avoid deflationary pressures.

So, there's nothing new here, and this rate cut, largely priced in, will have no impact on the markets in the days ahead, apart from money-market funds and other short-term investments, whose yields will adjust further downwards, further improving the relative profitability of 1–3-year bond investments.

There's nothing new on the credit front either, where we continue to observe a primary market that is still favourable for issuers (cf. weekly May 16, 2025), and from which we remain particularly aloof, as spreads are so tight in relation to risk, apart from a few special cases, most often to capture the issue spread, but these opportunities represent barely 8% of the number of corporate and financial issues this week. Once again this week, we note the large number of corporate issues that are generally not very attractive to investors for simple “carry” purposes, as they are generally opportunistic and/or cyclical - both in terms of their activity and their credit quality - and/or relatively illiquid in the event of a market downturn; issues whose yield/volatility ratio is therefore rather unprofitable when subscribed to on the primary market or when spreads are tight, and which we prefer to acquire in their volatile phases. Here are a few examples of issues and the reasons why they are significantly more volatile than others:

- Lagardère: a holding company now focused on the publishing business, relatively cyclical, with uncertain governance and strategy, and unrated (and therefore inaccessible to many investors) and illiquid bonds. If the pricing were attractive and the spread high (precisely because of the shallowness of investors in such an issuer), we would reserve this type of issue for a possible short-term opportunistic investment but would prefer not to take a structural exposure to it.

- Forvia: cyclical par excellence due to its sector of activity, this issuer, whose agility in terms of financing we have often praised (cf hebdo of September 30, 2022), has just issued a 5-year bond with a 5.6% yield, i.e. a spread of around 340bps on the swap curve. Since their inauguration in March 2025 alone, these same 2030 bonds (since this was a resubscription) have already seen a variation of nearly 8 points downwards and then upwards, i.e. 1.4 times the total annual yield... which justifies staying away, either because we consider the Sharpe ratio of such an investment to be too unfavourable, or because, given the current volatility of the global and European economies, we're more or less convinced that we have other, much more attractive and relatively frequent rate windows on such an issuer...

Sources: Amplegest, Bloomberg

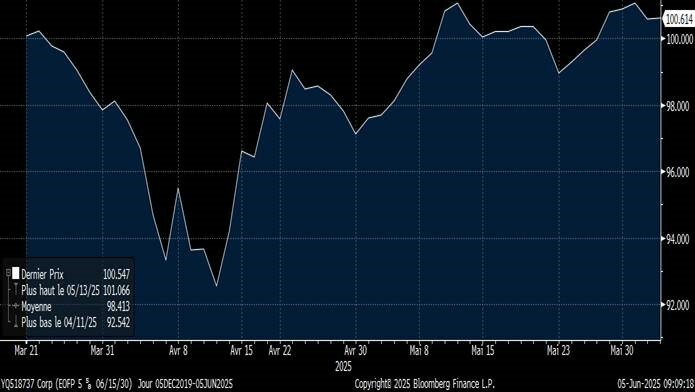

- And we'll finish with Worldline, the typical issuer we prefer to avoid in our portfolios (cf. hebdo of September 20, 2024); after numerous earnings warnings, a calamitous stock market performance, massive goodwill write-downs in 2024 leaving us with some doubts about the reliability of the accounting (since management seemed to have significantly misjudged its estimates, at the very least...), the company had been forgotten for a few months and was no longer making the headlines because of its setbacks... It has taken the opportunity to issue a bond, even though its credit rating is still investment grade but with a negative outlook, and investors have fallen back into their habit of seeking yield in recent weeks... However, nothing has fundamentally changed for Worldline in terms of its balance sheet, and we would again draw attention to the proportion of goodwill in long-term assets: 9 billion euros out of a total of 11 billion euros, or 82%... 82% of security accounted for in credit ratios on assets which are by definition uncertain, evaporable at the stroke of a pen and very difficult for an investor to quantify ... It's also worth remembering that the company's cost of financing has only gone up since its first issue in 2019. Back then, thanks to a convertible bond, Worldline was able to borrow with a coupon of 0%! In 2020, its coupon rose to 0.875%, which was still very low given that the company was still considered a flagship of European technology, valued at €22 billion on the stock market for sales of €2.5 billion and EBITDA of €600 million; then 4.12% in 2023, then 5.25% in 2024, ending today at 5.5%... With working capital of around 600M€, cash of 1.8M€ and total debt of 3. 8 billion euros and annual free cash flows of 200 to 300 million euros, one might be surprised that the company would agree to pay such yields, 100 to 200 basis points wider than its credit rating would suggest... Some managers seem to see this yield spread as an opportunity, whereas we consider that the balance sheet restated for goodwill is weak, that the track record is very poor and has not yet demonstrated a tipping point, or even that management is willing to pay such yields because it is not confident about the company's ability to meet its commitments in the future... In short, if Worldline had retained some of the ties and management methods of its former parent company, Atos, another company that is not a creditor's cup of tea (see weeklies of January 19, 2024, and January 24, 2025), we wouldn't be surprised... The apple doesn't fall far from the tree, as the saying goes...

In order not to overload this weekly issue while still providing as much information as possible, we will list some of the week's issuers in a table below, together with the reasons for non-investment, which has been much more numerous in recent weeks than our investments:

To conclude, we would point out that liquidity has plummeted in recent weeks, as investors are so focused on a single market direction: buying corporate bonds: Spreads initially narrowed sharply, and now a virtual scarcity has developed on certain corporate bonds... However, we believe that these flows merely reflect investors' disaffection with other, riskier assets such as equities, whether listed or unlisted, or other asset classes still on standby such as real estate; a disaffection which does indeed stem from the persistent uncertainty surrounding the economic situation, and which therefore does not merit an increase in credit risk in order to scrape together a few basis points of additional carry - quite the opposite... As for interest-rate risk, we talked about it in our May 23 weekly, and our opinion was not particularly optimistic!