11 July 2025

France Trésor, a booming institution! What a pity...

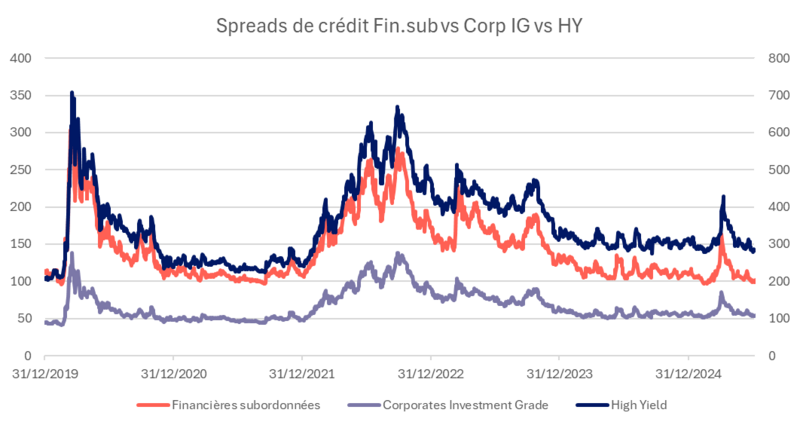

As we enter our final weekly of the season, there has been little news to enliven the credit markets, which have become accustomed to the prevailing uncertainty and are continuing on their carry path with almost no jolt, as the credit spread graphs below attest.

In this context, many credit managers, who had remained cautious since the famous Liberation Day, may have fallen behind their indexes, a phenomenon observed both in credit and in certain parts of the equity market. At mid-year, the temptation may be great to reweight portfolios in credit risk or duration to catch up with the indexes, as shown by Agefi's monthly survey, published at the beginning of the week and showing each month a more positive panel on the asset class, even though it is yielding a little less each month, while risk clearly does not seem to be falling. That is to say the risk/return ratio tends to be less favorable to investors. We are even surprised to see that some investors, often very large and with considerable inertia, after having preferred a structural underweighting of credit for over 2 years, are now advocating a significant increase in their risk-taking as we enter the second half of the year...

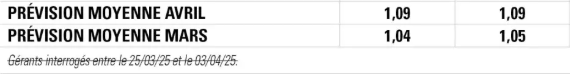

Ultimately, nothing has changed in the financial sector, which remains as procyclical and unpredictable as ever... The week's other example is the outlook for the euro. A few weeks ago, as long as it was oscillating between 1 and 1.1, all currency specialists saw it staying there, as shown by this April panel; now that it is at 1.17, forecasts for the next 3 and 6 months have moved to 1.18... following only the observed level adjusted by one basis point for the uptrend...

July level : 1.17

April level: 1.10

March level: 1.04

Source: Agefi

This phenomenon of adjusting forecasts and therefore taking positions a posteriori is probably what is also happening on the credit markets, and the lower spreads and yields fall, the greater the risk taken on the segment, both because of the “yield chasing” phenomenon - some investors need an absolute rate of return and therefore have to downgrade the quality of their portfolios as yields fall - and because of a classic “trend following” phenomenon, quite characteristic of the financial markets.

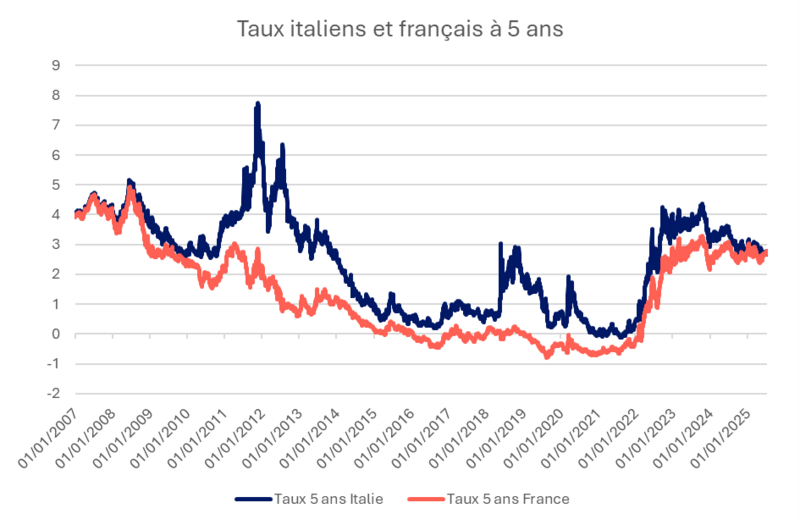

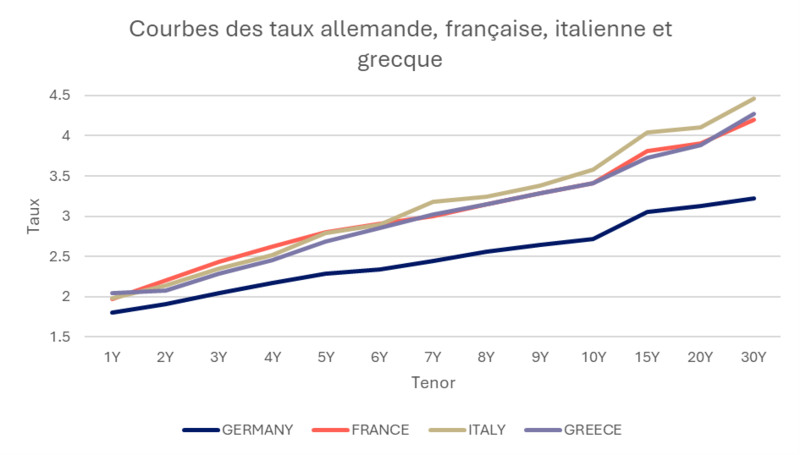

One last word before the hebdo Crédit returns to its summer quarters to meet you in September: the continued relegation of the French sovereign compared to its European peers. We've been talking regularly about the fact that France is the Eurozone's worst performer for several months, if not years now, and since June 2024 we've removed most of the French risk from our portfolios, particularly in certain sectors such as banks, insurers, utilities, energy or any other sector or company linked to the sovereign or to public orders, we didn't think that the reclassification phenomenon would be so quick, and we must confess to being surprised to see French sovereign yields exceed those of Italy on the 5-year maturity this week. The 10-year will probably follow in future French issues on this maturity. This phenomenon has as much to do with France's deterioration as with Italy's improvement, and we don't think that a runaway effect on French debt, as seen during the peripheral crisis, is likely in the short term. Nevertheless, we judge that the risk is clearly not sufficiently remunerated, and we would still prefer to avoid French risk in favor of Italian, Greek, Spanish or Portuguese risk, with comparable remuneration but a much more favorable credit trend, both from a budgetary and an economic, and even political, point of view. "Surely France is not the country with the highest interest rates in the Zone? That leaves Greece, doesn't it?" some readers may ask... Well, no! France does indeed have the highest 5-year rate, while Greece and Portugal, with their tighter budgets and less need for new debt, have seen their rates fall well below French levels... The “Club Med” or ‘peripheral’ or “Piig” countries have indeed found their way back to the heart of Europe, while France continues to drift away, alone...

Matthieu Bailly

Matthieu Bailly