04 July 2025

S1 2025 bond markets review

As the first semester of 2025 draws to a close, and our traditional mid-year weekly review of bond performance arrives, it's clear that the concerns and expectations expressed at the start of the year in terms of uncertainty, volatility and lower performance than in 2024 have been borne out: carry was lower, spreads were more compressed, and macro and geopolitical issues were piling up without being resolved.

And if we had to sum up this half-year of bond market performance, we'd say that the trend of 2023 and 2024 has continued, but shows a loss of steam that should become even more pronounced in the months ahead, given how rich spreads already are:

- The riskiest categories in terms of credit risk (High Yield and financial subordinates) have again significantly outperformed the least risky categories (Govies and Investment Grade) (see graph 1)

- The rates component has again been the source of the highest volatility, without sufficient carry to absorb it over these few months. (see graph 1)

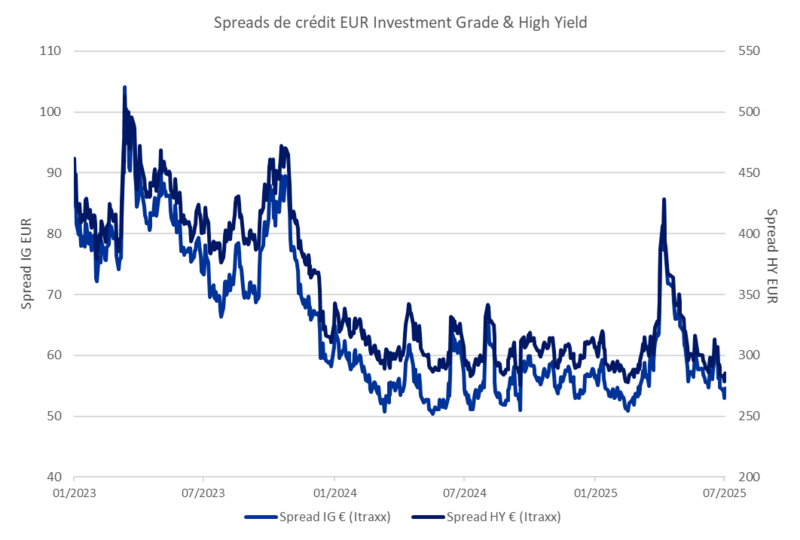

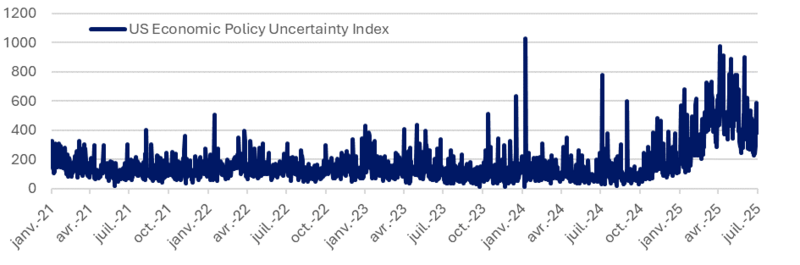

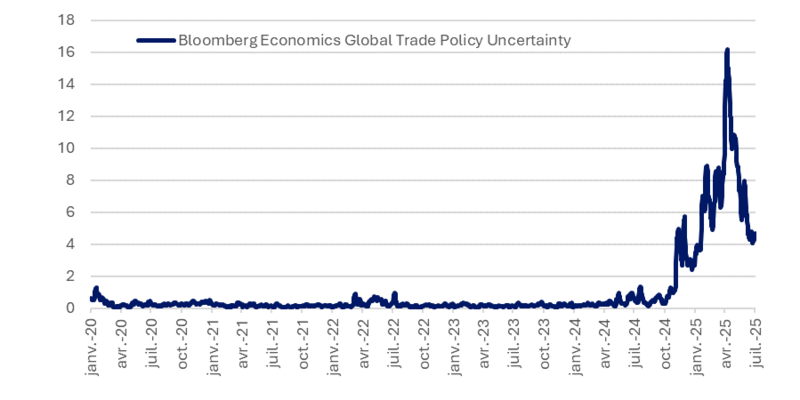

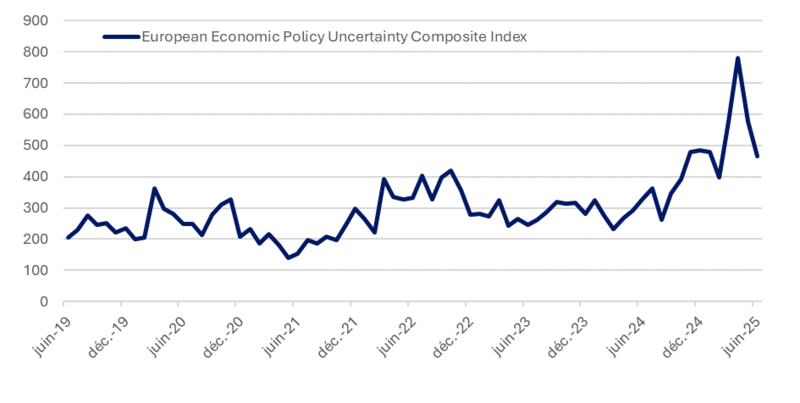

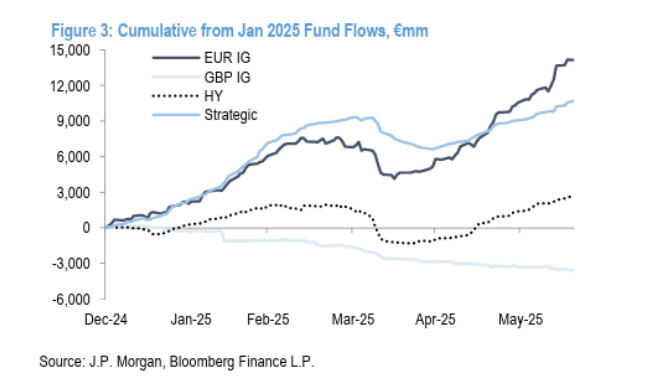

- While the credit component was almost sufficient to absorb all shocks between 2023 and 2024, this is no longer the case today, due to tighter spreads (see graph 2) and the scale of uncertainty (graphs 3-4-5), unparalleled even during the CoViD phase, which on the contrary offered some degree of visibility in terms of policy, monetary trajectory and global cohesion.

Graph 1:

Graph 2:

Graph 3:

Graph 4:

Graph 5:

Source: Amplegest, Bloomberg

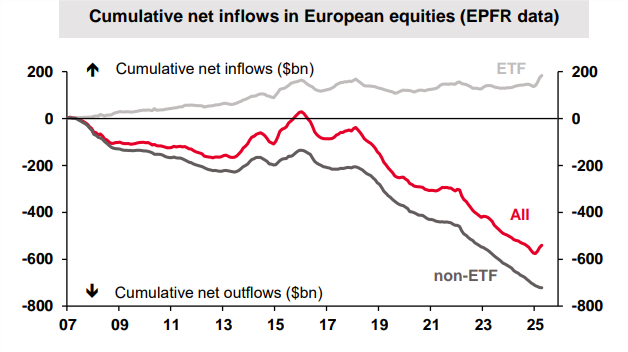

As a result of this uncertainty and the fall in ultra-short-term money-market rates, investor flows over the past six months seem to have been directed primarily towards bonds, as shown in graph 6 drawn up by JP Morgan's teams, while equities have seen a decline in outflows, particularly from active management, undoubtedly driven by concerns about world trade and growth, as shown in graph 7 (source: Société Générale):

Graph 6:

Graph 7:

Massive inflows were thus divided between the secondary market, where premiums tightened, and the primary market, in particular the High Yield segment, which broke new issuance records, particularly towards the end of the semester (see graph 8). There is a certain logic to this phenomenon, but it needs to be monitored with great care: the lower rates and credit premiums fall, the more the “hunt for yield” becomes the norm, and the tighter the premiums for the most downgraded categories and issuers... We believe that we are currently entering this type of phase, and that it is preferable not to give in to it, for two reasons:

- Corporate quality is tending, at best, to stabilize, if not deteriorate, which is not consistent with lower remuneration.

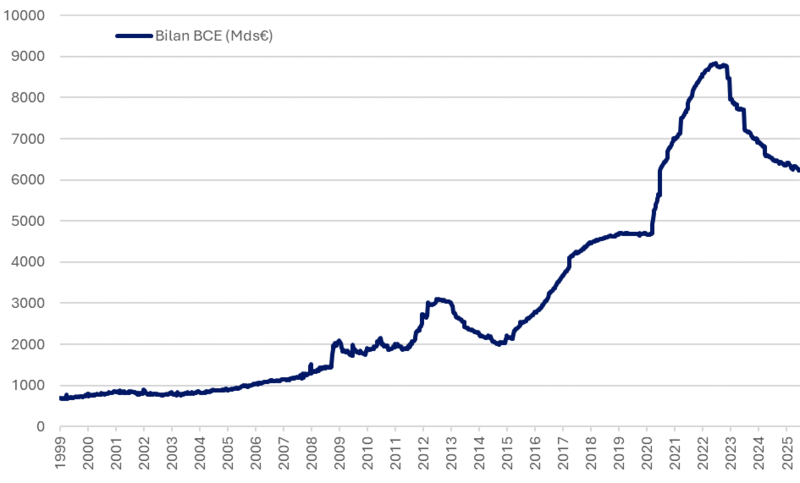

- Central banks are not as accommodative as they were between 2015 and 2021, neither in terms of policy rates nor in terms of asset purchases (see graph 9 : ECB balance sheet)

These flows are more of a stopgap vis-à-vis other asset classes than a genuine opportunity in themselves, and there is clearly no longer any room for significant further tightening of credit spreads: both outcomes, renewed optimism or accentuated pessimism, would therefore seem to us to be rather negative or neutral for further bond risk-taking.

Graph 8: High Yield issues in the 1st half of each year

Graph 9:

Source: Amplegest, Bloomberg

In conclusion, we remain cautious for this early summer, preferring short-to-intermediate durations, average credit quality between BB and BBB, and a few percent cash holdings to avoid and/or take advantage of potential illiquidity phases that can easily arise during the summer break. We avoid most primary issues, which are clearly more of an opportunity for issuers than for investors, and still prefer European financials to corporates, as their yield differential vis-à-vis corporates is still slightly favourable, while their credit quality seems more solid and stable to us due to regulatory pressure in the Eurozone (watch out for US banks) and higher rates favouring lower-risk income statements.

Matthieu BAILLY