27 June 2025

Most new obligations are to be avoided - Worldline, a lead painted with ESG gold and "French tech"

Market concerns over the situation in the Middle East were short-lived, and within a few days all assets had recovered the few basis points lost, particularly on the credit markets. In this context, and ahead of the summer break, the primary market remained quite prolific, and we continue to warn of low yields and spreads for most of these bond issues, with companies and their advisors opportunistically taking advantage of the market's appetite at a time when average credit quality is tending to deteriorate...

Among the types of issuers that seem to us to signal a certain “euphoria” in the European credit market, a feeling that is never lasting and is systematically transformed, a few weeks or months later, into falls in valuations and high volatility, we would note in particular :

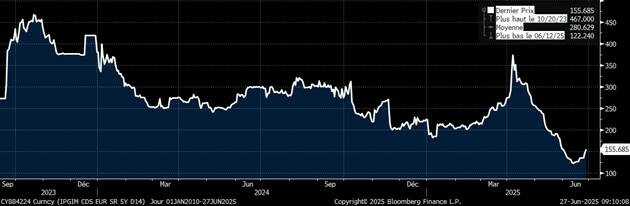

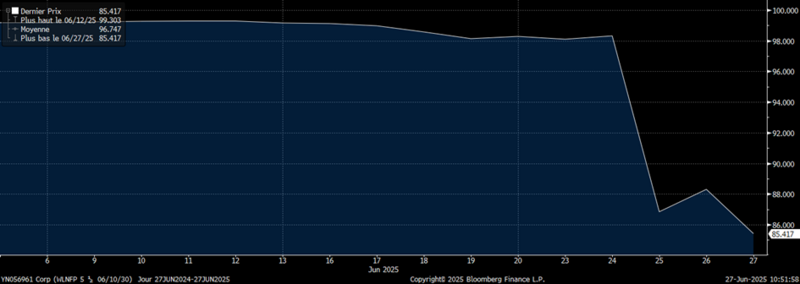

- Issuers with the financial skills and experience to “time” the market: while these issuers are to be congratulated on their ability to defend their interests by borrowing at low rates and systematically guaranteeing their refinancing with dexterity and comfort, they rarely offer opportunities for investors on the primary market, by definition. Of particular note here are CMACGM and Webuild, which issued this week 6-year bonds yielding resp. 5% and 4.1%. A glance at CMA's 5-year CDS, the only benchmark that enables us to observe credit consistently over the long term (since bonds have melting maturities and are regularly repaid), will show us that CMA has once again chosen the right moment to minimize its borrowing costs, both from a long-term perspective and over the last few months, having carefully avoided the small peak in April to issue on its historically low spread... Clearly not an opportunity for the investor, then... Same thing for Webuild, for which the history is less long but just as telling...

Sources : Amplegest, Bloomberg

- Issuers offering a high premium in a low-yield market: these are generally unable to issue when the bond market is generous, as investors can find good issues with already attractive yields. On the other hand, when yields shrink, investors may be tempted to let their guard down. This week, for example, we note the 5-Year issue of Clariane at almost 8% yield, whose attractive new name, which is better at making people forget the past than “Korian”, should not make them forget the company's past and its heavy debt load... The same goes for Garfunkel at 9. 5% and 10% over 3 and 5 years, a company operating in the debt collection sector, which is in great difficulty and has already seen some of its operators restructure their debt.

- Exotic first-time issuers: here again, periods of “yield-seeking at all costs” are often conducive to the arrival on the market of issuers that are more exotic than the average, but which may appear “fashionable” and satisfy investors in the short term for a high risk in the long term. In this context, this week we'll be highlighting two issuers that would never have been able to issue a year ago, but which, because they manufacture weapons, now manage to find takers, perhaps even in some SRI-labelled funds! We're talking here about Maxam Prill, a Spanish manufacturer of explosives, which issued at a 6% yield over 5 years, and Czechoslovak Group at 5.25% over 6 years, a company positioned essentially in military vehicles and created at the height of the break-up of the Soviet bloc, in 1995, whose very name may seem surprisingly outdated since the split of the Czech state and Slovakia, in 1992!

- Reverse Yankees, or American issuers issuing in euros to European investors: generally well advised and opportunistic, American companies, which only care about the euro when it is particularly advantageous for them, are a harbinger of a credit market that is rather at the end of its course and more favorable to issuers than to investors. Over the past few days, we've seen issues from Ford, Honda, Modulaire, Prudential Financial and Sketchers in this segment,

All these factors mean that we remain very cautious about our positioning, both in terms of credit risk and duration risk...

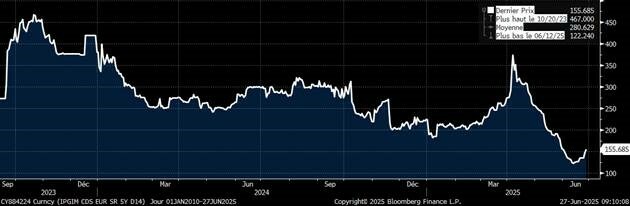

And we can't end this weekly without mentioning the case of Worldline, the issuer we warned against a few weeks ago for its lack of reliability, its uncertain accounts and governance, its strategic wanderings in line with those of its former shareholder Atos, about which we have also written extensively, and the major risk to its balance sheet boosted by goodwill. (cf hebdo of June 24, 2022) This week, a journalistic investigation into fraudulent payments has lit the fuse: the shares have lost over 30% in a few days, 95% since 2020, and the bonds issued just two weeks ago have lost 13 points, i.e. almost 3 years of coupon! (see graph below)

Sources : Amplegest, Bloomberg

If, of course, we were not exposed to the name, we would gladly support a legal initiative by the bondholders on the grounds of latent defect, as it seems obvious to us that the company has taken advantage of an asymmetry of information, or even warnings about the outcome of the said survey, to issue in the last window open to it... According to the European Investigative Collaborations network, Worldline transferred some of its Belgian subsidiary's “High Brand Risk” customers linked to gambling, pornography and even prostitution to its Swedish subsidiary, in order to conceal them. We believe that this investigation and these wanderings, similar to those of Orpea in another sector, could sink the entire company, and even at yields of 8 or 10% we believe that Worldline must be avoided at all costs, whatever the support of its reference shareholder BPI (which we find very surprising in view of the extremely serious accusations), a support which seems to us to reflect more of an attempt to save the day at all costs than a balanced support.

Finally, for the anecdote and to end on a smile, we will take pleasure in seeing that Worldline was ranked among the best ESG ratings with an AA rating from MSCI, a risk score of 13. 7/100 at Sustainalytics, a controversy level of 2/5 and an environmental ranking in the top 1%, which the company boasted about in numerous press releases even though, given the sector, it is logical that the company spends less on raw materials or energy than the industrial sector, and this ranking had no value in itself... This example, like that of Orpea in its time, which was just as well ranked, shows us once again that ratings, labels and other ESG rankings, although widely encouraged by many regulators and public initiatives, are a smokescreen, a source of more marketing and financial drift than reliable risk management and responsible finance.

Matthieu Bailly