16 May 2025

Is the primary market picking up again an opportunity? Yes, but for borrowers!

Long gone are the days when central banks weighed so heavily in the game that they provided investors with an extremely clear view of the future... And while the ECB and the FED, between 2022 and 2023, looked fairly sure of themselves, given that inflation seemed the most important issue to manage and deserved a clear direction on their policy, the multiplicity of parameters and their volatility has forced them to settle for navigation at sight for several months now... A form of navigation markets had long forgotten, which, coupled with two other factors, make it even more difficult for investors to form a clear idea of the right price, thus creating very high levels of volatility:

- The sheer volume of capital at stake since the widespread quantitative easing of the 2010s and beyond.

- Political and geopolitical issues, which parameters - whatever analysts and economists may say, because they have to justify their work - are virtually impossible to enter into market pricing and risk management tools, and yet have been the most consequential for several months: Ukraine, the Middle East, the ongoing US/China war of influence, which could last for decades, the loss of influence and European posturing on the world stage...

- High volatility of economic parameters, from statistics to forecasts and surveys, making price models equally volatile.

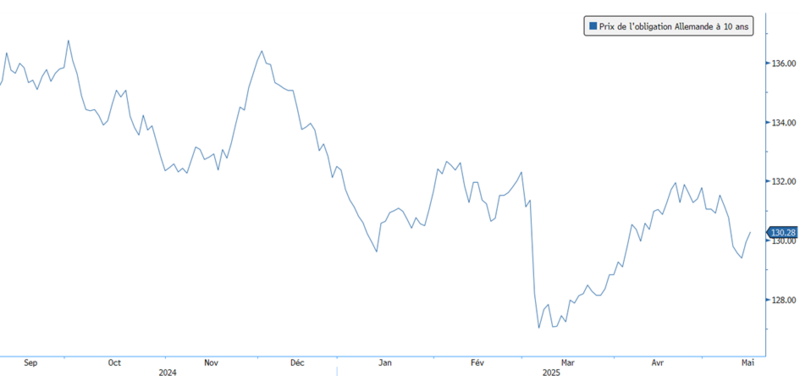

Against this backdrop, the longer the bonds - which is the subject of this week's issue - the more they have struggled, over the last few months or even years, to offer investors an appropriate yield/volatility ratio - as measured by the Sharpe indicator - as illustrated, for example, by the variations in the German Bund over the last twelve months, which price has fluctuated by almost 10 points, i.e. almost 7% on average over the period, even though it offered an annual yield of 2.4% on average. In other words, to get a yield of 2.4% per annum, an investor would have had to incur capital gains or losses three times higher, and several times during the year... a far cry from a “quiet” investment...

Sources: Amplegest, Bloomberg

Bonds, however, are the place that investors generally choose for a certain tranquillity that does not go hand in hand with this type of asset behaviour.

As a result of the three factors mentioned above, to which we can add the incompressible need for governments, especially European governments, to increase their debt levels over the coming decade, which should push up long-term sovereign interest rates, we believe that this corrugated iron phenomenon, which is highly detrimental to the risk-adjusted performance of a bond portfolio, will continue... But that it is nonetheless possible to avoid it by focusing on three areas:

- Corporates rather than sovereigns: better managed, unable to use debt ad vitam and without limit, with a time horizon more consistent with that of investors than political and geopolitical developments and moreover offering a yield premium that somewhat absorbs volatility.

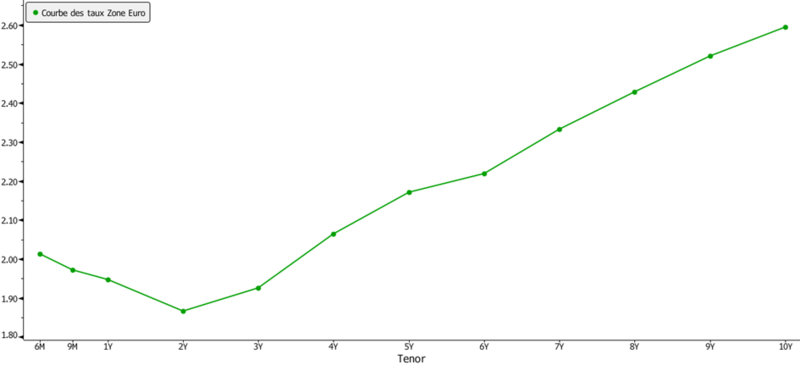

- Short and intermediate rather than long maturities: if neither central banks, institutions nor corporate management (as evidenced by recent earnings conferences) can provide a clear vision of the future, why should an investor who takes these three factors into account? Similarly, why take more risk by investing for the long term (because investing for the long term rather than the short term is indeed an additional risk) when the return is virtually identical on shorter maturities

Sources: Amplegest, Bloomberg

- Companies less exposed to geopolitical risks: for example, while China could be a very long-term investment opportunity for an equity investor, as it could generate considerable capital gains given its dominant position in the world, a bond investor might stay away, as Chinese bond yields do not currently offer sufficient returns given the current political, monetary and geopolitical risks, and alternatives with similar yields can easily be found for a risk that is more manageable for a European investor.

- Finally - and our readers may say that we're not being very objective in this observation - in these market conditions, we continue to prefer flexible management to indexed bond management, as it enables us to make these choices of maturity or issuers, whereas an ETF will invest mechanically in the existing bond pool, depending on the amount of debt present on the market... So, the more debt an issuer has in absolute terms, the more an ETF will buy, and the longer issuers borrow - which would mean it's profitable for them and not for the investor, i.e. yields are low or the curve is inverted - the more the ETF investor will have a long-term investment... Even though a sensible investor might logically prefer companies with low debt levels and the point on the curve that is most profitable for him, and not the most favourable for his debtor...

Against this backdrop, we have seen the primary corporate bond market blossom in recent weeks, after the “Donald Trump” episode of volatility that closed it for some time, and it could be tempting for investors to position themselves to capture a few premiums or find new opportunities. We're not particularly keen on this, and will only position ourselves on a handful of issues, for several reasons:

- The window is particularly favourable for issuers in terms of credit spreads, given that after the volatile April episode, they have returned to their lows, even though the economic situation and outlook are nonetheless worse than they were a few months ago. Flows have been favourable to the corporate bond market in recent weeks, and borrowers know how to take advantage of them.

- Many of these issues have very long maturities and involve companies with narrow credit spreads of between 50 and 100 basis points. Infrastructure, utilities, and energy companies are legion in this segment, and this week's issues include Abertis at a spread of 235bps and a yield of 4.75% on call 2030, Transdev at a spread of 90bps and a yield of 3.054% on a 3-year maturity, and L'Oréal at 10 years and a spread of 90bps. Given the high volatility of long-term rates mentioned at the start of the week, this type of positioning, even for a few basis points of premium, does not seem appropriate to us, unless you are an institutional investor with very long liabilities and no concern for mark-to-market.

- Another proportion of these issues are opportunistic borrowers, with highly volatile business lines, credit quality and spreads. Well advised by their investment banks, they generally borrow on the markets at the most opportune moment for them, but not for the investor, who may have to endure setbacks in the months ahead, such as a profit warning, a rating downgrade, a sharp rise in the credit spread and hence a fall in the price of his bond. Among these issuers are Valeo, AvisBudget and Air France, whose yields can vary from 5% in favourable market phases to 8% or 10% in more unfavourable ones. The yields on their issues this week were rather close to 5%, and between an American equipment manufacturer, an American car rental company and an airline whose debt and restructuring difficulties regularly make the headlines, we can't say that they are free from concern in the current economic climate...

- Although we don't include them in the previous category, it's close to it for the investor in terms of risk: issuers on the edge of the investment-grade category who take advantage of their status and inclusion in ETFs and other investment-grade portfolios to borrow cheaply, and often over the long term, before a possible downgrade. In this category, we would point out cyclical issuers with BBB or BBB- ratings, because the coming economic cycle looks rather unfavourable, a fortiori in Europe, dragging these BBBs into the high yield category and pushing up credit spreads and causing performance to plummet... Please note that we are not saying that these issuers will necessarily default, and perhaps they will be a bond opportunity once the downgrade has taken place and yields have jumped, but we prefer to avoid them today, as their yields reflect the past rather than the future - remembering here that credit rating agencies are not really forward-looking, as we have often shown in our weeklies... - Among the issuers we will therefore avoid, we would cite the new issues of Philips (BBB+) at 10 years with a spread of 150bps, i.e. a yield of 4. 05%, Icade (BBB) 10 years at a spread of 197bps, i.e. a yield of 4.38%, Heidelberg (BBB) 5 years at a spread of 90bps, i.e. a yield of 3.23%, DVI (German real estate BBB-) at a spread of 275bps, i.e. a yield of 5.1%.

If we therefore advocate selectivity in the bond market, this is even truer for new issues, because they are generally more of an opportunity for the borrower than for us as creditors, except in phases of liquidity scarcity, This is not currently the case on the corporate bond market, which will continue to attract investors thanks to its still significant yields, its high visibility, particularly on short to intermediate maturities, and its moderate risk in the current very uncertain, even gloomy, economic and political climate...