09 May 2025

Octo couldn’t find the right fit at Golden Goose.

As the weeks go by, the trade negotiations that Mr. Trump started with a bang are continuing more calmly, without the markets really taking notice. Some agreements have been reached, such as with the United Kingdom, while other discussions, such as with the European Union and China, are still at the stage of intimidation, although the tussles are never quite balanced...

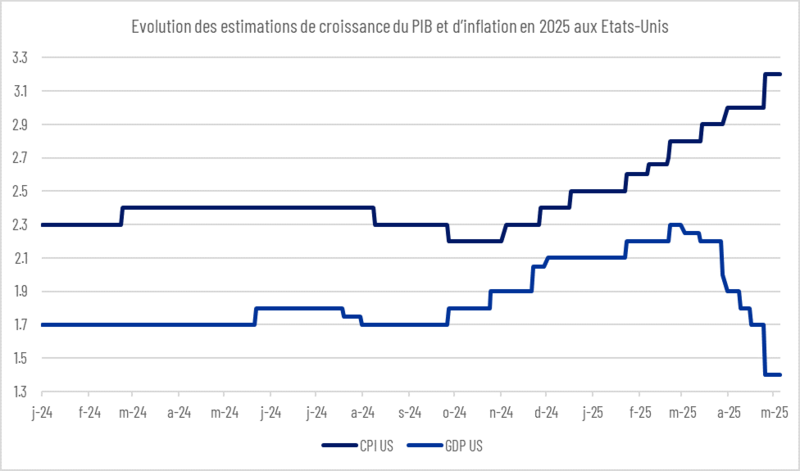

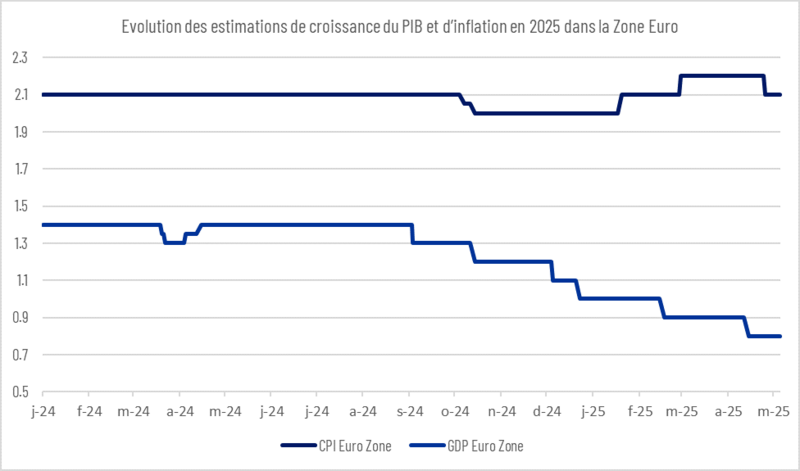

And if the economic statistics and outlook, penalized by these gesticulations which come in an already delicate context, between slowing growth resulting from higher rates and still persistent inflation (and customs duties may yet contribute to this), do not augur well on either side of the Atlantic, as shown in the graph below, investors seem to have regained their appetite for risky assets, which valuations have almost all returned close to “pre-stress” levels.

Sources: Amplegest, Bloomberg

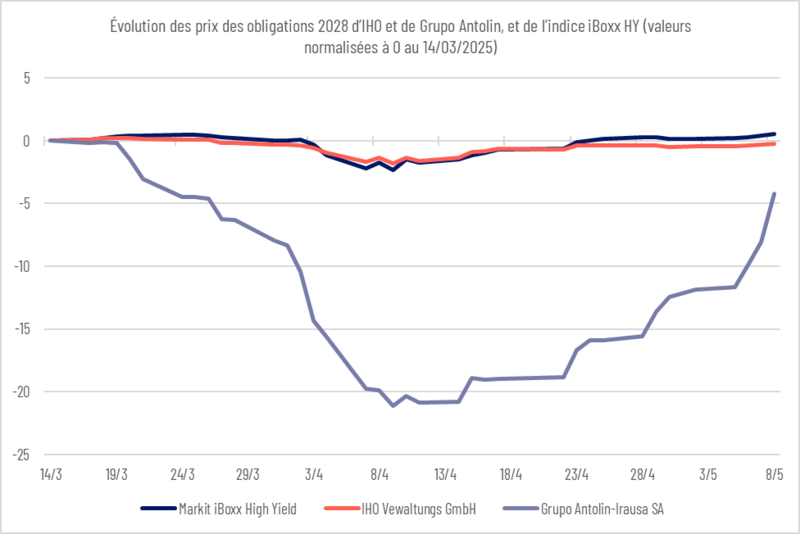

Against this backdrop of a more sustainable rebound, we note that bonds which we consider to be “value”, i.e. offering a yield premium and being, by definition, a little less in the heart of the market, have in recent days been significantly catching up with the indices, as shown below by the example of Antolin 2028. Heavily hit during the first days of the customs duty declarations, this Spanish issuer, with just two bonds for a total of 640 million euros, had hardly bounced back like the indices, and certain very weighted issuers, Germany's IHO Verwaltung, with its 3.5 billion in bond debt, which has followed the movements of the European high yield index to the day. While the market's indices and blue chips had returned to an even performance by mid-April, value bonds such as Antolin had accumulated a certain lag, which they have continued to make up in recent days.

Sources: Amplegest, Bloomberg

Among the week's news of renewed risk appetite in the bond market, we also note the issue by Golden Goose, the famous manufacturer of star-spangled, “pre-loved” tennis shoes, on a 2030 maturity. There are several indications in this issue that the credit market may be slipping back into complacency because yields have fallen somewhat, because the asset class remains attractive given the valuation levels of others, and because bonds are an attractive compromise in the current climate of uncertainty. Among these elements, we note:

- A high-risk sector for the high-yield market: many companies in the fashion sector have collapsed following LBOs, due to high cyclicality, rapid product obsolescence, high development and marketing costs, and high cash consumption. It is therefore in phases of rather optimistic credit markets or very low interest rates that this type of company manages to offer bonds that find their audience. In the case of Golden Goose, the first issue was in 2021, when yields were very low, and consumption was in full recovery.

- A company of modest size, highly concentrated in terms of product: we were surprised, in Golden Goose's investor presentation, to see the comparisons used by management to support their figures and skew the reader's point of view. These included Hermès, LVMH and Prada, all companies whose size, diversity of products and ranges, and geographical reach are quite different. For example, Hermès has sales of 15 billion, while Golden Goose has sales of just 500 million... LVMH boasts a range of dozens of brands, while Golden Goose is only known for a very specific type of shoe, making sales and cash flow much more uncertain.

- Creditor-unfriendly use of cash: while most companies take on debt to finance their production facilities, some, more aggressively and often under LBO, use bonds as a tool to pay themselves a dividend. This completely reverses the classic balance sheet hierarchy, since the shareholder pays himself a dividend even before the company has generated sufficient operating cash flow to do so. And the more uncertain future operating cash flows are, the more objectionable/deplorable this type of operation becomes. Indeed, we could imagine a power line or freeway concessionaire paying itself this type of dividend advance, insofar as cash flow visibility is very high; but in a sector such as fashion, which is extremely cyclical, using debt to pay itself a dividend seems to us to be extremely negative for the creditor on two counts: firstly, the company is instantly more indebted without any quid pro quo, and secondly, in the event of default, the recovery rate will be correspondingly lower. In the case of Golden Goose, we note that €100 million of the €480 million raised will be used for a dividend, even though the company's total cash position in 2024 was €150 million, annual net income was €50 million and annual free cash flow was between €15 and €20 million.... The shareholder will therefore be paying himself between 2- and 5-years’ cash advance on this operation, even though the new creditors will be carrying this risk for him... For although management claims to be drawing on its existing cash for this dividend, it is in fact the same cash in fine, and to draw 100 million out of 150 from the balance sheet without the support of new creditors would have been quite perilous for the future...

- Unprotective indenture language: the investor protection or issuer latitude clauses, traditionally referred to as “covenants”, are indicative of investors' risk appetite and hence their permissiveness towards companies. For example, at the end of the 2010s, after 5 years of starving yields, investors were prepared to make any concessions to obtain a hint of a credit spread, and covenants became very unfavourable to them, giving companies free rein and reducing protection in the event of bankruptcy or deterioration in credit risk to virtually nothing. Since 2022, these covenants have been tightened, as bond investors have become more demanding in the face of rising interest rates, and therefore less interested in capturing a few basis points of additional credit premium.

The case of Golden Goose shows that credit investors are becoming less vigilant, with rather loose covenants:

-

- A call in the event of an IPO before the first call date (making the potential gain very limited for the creditor in the event of a favourable scenario),

- A “restricted payment” clause, i.e. a ban on the use of cash for certain purposes (including dividends or other shareholder reimbursements), which is rather flexible, with an exemption of 100 million for the dividend.

- The absence of a brand transfer clause in a subsidiary excluded from the holding company's restricted scope, to avoid becoming the creditor of an empty shell: as the Golden Goose brand is virtually the company's only asset, we consider the absence of such a clause to be very dangerous for the creditor.

- Finally, we note that all the protective covenants would disappear in the event of an investment grade rating or IPO, which is a lesser evil for three reasons: 1/ the company is a long way from achieving such a rating, and is unlikely to do so in the next 5 years; 2/ an investment grade rating would mean de facto credit quality and liquidity that are very protective for the creditor; 3/ an IPO would most likely trigger repayment of the bonds, as the company would be able to find cheaper financing.

In conclusion, our readers will have understood that the Octo Funds management team will not subscribe to the Golden Goose bond for several reasons:

- An abysmal track record in the fashion sector for LBO-type high-yield debt: let's recall the fate of creditors of IKKS, SMCP or Vivarte...

- A modestly sized, single-brand company based on a single flagship product that is easily replaceable by consumers, with a rather risky operational and competitive profile: this positioning does not offer sufficient visibility to our creditors regarding the bond's expected profitability.

- AA prospectus and investor presentation reflecting aggressive management and sponsorship, more concerned with marketing than with consistency and accuracy, and little inclined to treat the creditor as equal to the shareholder - which, in such a high-risk credit dossier, we find prohibitive.