16 January 2026

STAYING AFLOAT IN TROUBLED WATERS

While, in line with last year, 2026 opens with particularly high valuation levels across all risky assets… and, at the same time, with a continuation of the upward trajectories of assets considered as safe haven, we held, on 13 January, our traditional credit outlook presentation at the Bristol. Here are the key takeaways, structuring elements and salient conclusions.

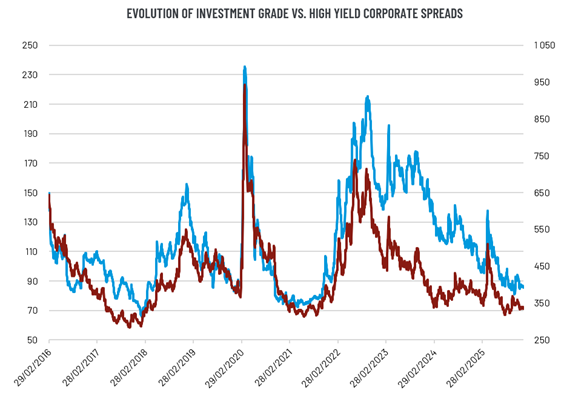

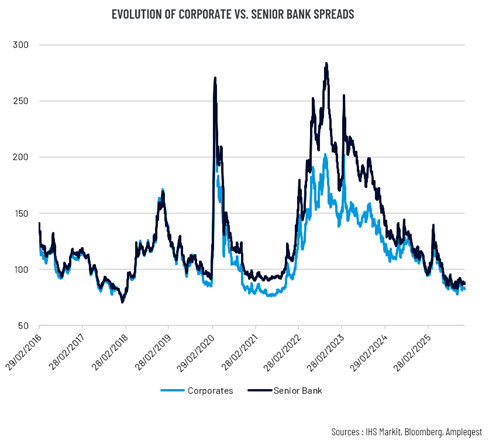

That markets as a whole are continuing their evolution in line with the end of 2025 only reinforces a fundamental reality, one might even say a gravitational one: given the levels of risk premia across all markets (cf. charts below, for credit), it is not only illusory to believe that this new year will be free of episodes of heightened volatility, but to hope that this volatility will remain confined, as it has been until now, to the sole “rates” dimension of the markets we focus on… even though reading the outlooks published by the main global banking institutions at year-end can feed such illusions.

Let there be no mistake. The statement that underpins most of their conclusions, according to which all the themes that structured market moves in 2025 should evolve in a direction favourable to another strong performance across all assets this year, however appealing it may be, is tainted by so many fragilities for us to be entitled to doubt its performative capacities (in the medium term) in markets characterised by such a compression of risk premia:

- Admittedly, there is every reason to set as a central assumption that the United States will remain in 2026 the main engine of global growth. But to postulate that the months ahead will allow a rebalancing of the structural imbalances that have led the US growth model to evolve in a K-shape - investments and advances linked to Artificial Intelligence coming to offset the growing weaknesses of large swathes of the real economy on the one hand, and consumption by the wealthiest quintile of households coming to overcompensate for the weakness of consumption among the least well-off households – seems to us, to say the least, audacious in view of the latest PMI surveys and the most recent employment report… Unless one envisages an unprecedented wave of fiscal stimulus (cf. below). Yet maintaining such dynamics is in itself a source of vulnerabilities, just as concentrating a portfolio on too limited a number of names is.

- Admittedly, the 47th President of the United States being who he is and 2026 being a year of Mid-Terms, there is every reason to believe that he will try by all means to polish his appearance ahead of this deadline, notably through fiscal channels. But from there to giving credit to all of his verbal sallies and forgetting the fact that this country has barely emerged from a Shutdown of unprecedented duration and that, despite the claims of the US administration, customs tariff revenues have absolutely not made it possible to restore the country’s deficit trajectory, there is a step that we will refrain from taking, preferring to underline the risks that this logorrhoea poses to the credibility of US economic policy… just as the increasingly frantic desire of this administration to take control of monetary policy, with the stated aim of precipitating a massive cut in policy rates…

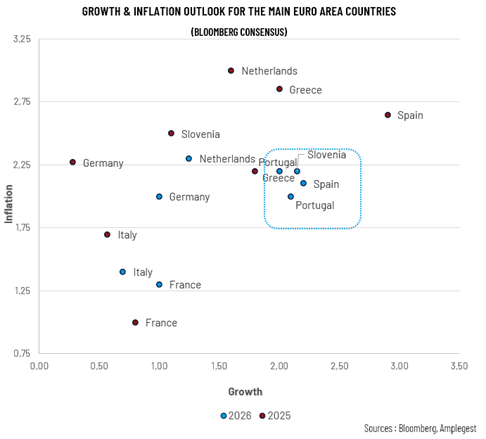

- And if, on our shores, one may reasonably assume limited growth without offending the slightest rationality, would it not be appropriate to question the real capacity of our neighbour across the Rhine’s investment plan to support growth across the euro area as a whole, in view of the realities of recent history? Would it not be desirable to measure the risks that divergences in economic trajectories between countries supposedly at the core of the area and former peripheral countries, today flourishing (but subjected in the past to austerity cures that would be difficult to envisage under our skies), place on the cohesion of the euro area (cf. chart below)? And further, can we really hope for a return of household consumption to support growth in the euro area, when their imagination resonates ever more with the sounds of marching boots and cannon fire… At a time when the intervention of US special forces in Venezuela is shattering all the principles that were trying to preserve for geopolitical balances at least the outlines of something familiar?

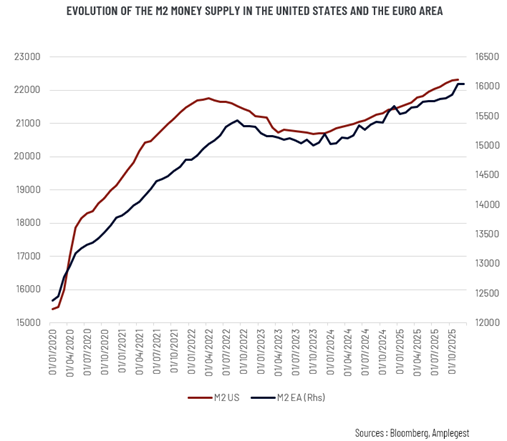

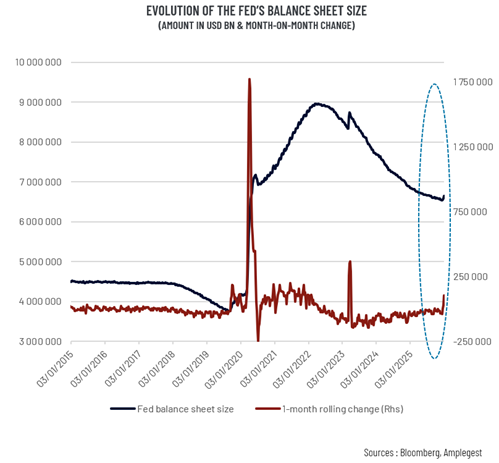

If the abundance of liquidity (cf. chart below) at the global level and the willingness (assumed, but manifest in view of the recent evolution of the FED’s balance sheet, cf. chart below) of central banks to ensure the stability of the financial system provide a credible limit to the risks of a (major) crash in the months ahead, they are not sufficient, nor will they be sufficient, to immunise it against an increase in volatility, across all categories of risky assets. A volatility that, once again, as far as our markets are directly concerned, cannot remain confined to the sole “rates” dimension (cf. chart below).

Consequently, in continuity with 2025, we have chosen to implement the following strategy in the management of our flexible funds, and first and foremost, OCTO Crédit Value for the coming weeks/months:

- Fine-tuned management of the funds’ duration by ensuring that it always remains lower than that of their benchmark indices, knowing that, at least on our shores, there is little to expect on the monetary front and that conversely the absence of any prospect of a reversal in the debt trajectories of most euro area countries, and indeed the globe, will continue to exert upward pressure on the longer end of curves. This fine-tuned management incorporates the tactical management of a pocket of rates futures, in order to take advantage of their volatility, and the optimisation of the duration of cash bond positions in order to maximise the benefit they could draw from curve steepening (carry roll-down).

- Maintaining our preference for Investment Grade at the expense of High Yield, given, not the deterioration of the microeconomic fundamentals of an asset class that has so far shown great resilience to shocks, but the drying up of the risk premia attached to it and its greater vulnerability to potential episodes of investor indigestion for risk. Maintaining this preference should however not be understood as neglecting the High Yield category, but as a desire to further increase our requirements in terms of risk/return trade-off on a segment which, beyond its overall strength, has seen a few cockroaches reappear in the last months of 2025 (to use Jamie Dimon’s expression).

- Maintaining our anchoring in (European) financials, insofar as an environment marked by sluggish (but positive) growth, a steepening yield curve and financially solid households, remains supportive for a sector that displays historical fundamental strength (and a capacity to absorb shock on sovereign spreads). More precisely, we will maintain our preference for Southern European countries whose macroeconomic prospects are more encouraging than at the core of the euro area and will always remain away from French financials.

- Further, beyond this anchoring, we intend to increase sector and geographic diversification of positions in our funds, diversification being understood as a means of increasing the resilience and shock-absorption capacity of our various funds.

- On the OCTO Crédit Value fund, we intend to keep in place the hedges that we initiated in 2025, knowing, not so much that their cost was paid over the financial year ended 31 December, but that at their current level, their potential evolution is asymmetrically directed upwards and that they should help increase the fund’s performance in rough seas.

Finally, more broadly we intend to keep at the core the Value DNA and the principles of agility and prudence that have made the success of our OCTO funds so far. And more immediately, to keep on our funds a buffer of (quasi) cash in order to take advantage of all bouts of volatility to optimise the rebound capacity of each of them. Because while volatility can be frightening, it remains and must above all be understood as a tremendous opportunity to increase the performance of our funds. And it is in this spirit, fundamentally optimistic in the face of uncertainty that I present to you, on behalf of the entire OCTO funds management team, our best wishes for this opening year.

Mathieu CRON