25 April 2025

Bond investors: Everything changes, nothing changes... Focus on the opportunity presented by dollar bonds

For several weeks now, bond markets have been reacting to political and trade announcements from the US president, creating significant volatility and raising questions about whether or not to make adjustments to portfolios with every move in either direction.

To sum up our thinking and our weekly report in a single sentence, we believe that these movements are erratic, do not reflect anything in particular in the medium term and that it is therefore pointless, even counterproductive, to change bond positions at this stage, although we may very gradually acquire a few positions as certain yield or credit spreads widen.

Firstly, given the setbacks on the equity markets and the traditional correlation between these markets and credit, an investor might imagine that corporate bond yields could have risen significantly, especially in the high-yield segment. While it is true that the spread indices commonly used as benchmarks saw their levels jump for a few days, we would note two points:

- 75% of the spread increase was absorbed in the days that followed, quickly rendering this potential opportunity null and void.

- Trading ranges have widened considerably in recent weeks, creating a significant gap between the apparent opportunity and the reality of a bond purchase.

- The spreads on the indices were not necessarily followed by bonds.

- In Europe, spread widening has been offset by a tightening of benchmark rates.

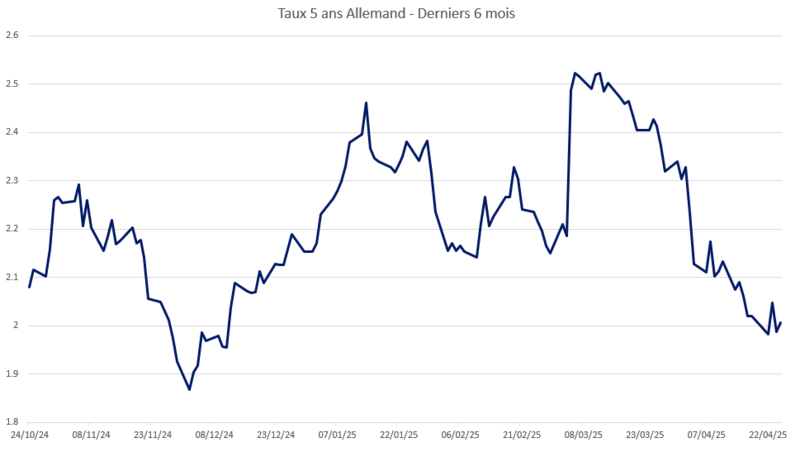

Thus, over a five-year horizon, generic high-yield spreads are currently around 50 basis points higher than they were in March, rising from 300 to 350 basis points. At the same time, the European benchmark rate for this maturity, generally represented by the 5-year German bond, tightened by 50 basis points, from 2.5% to 2%.

Sources: (Bloomberg, Octo AM)

Ultimately, therefore, for most investors positioning themselves on an absolute rate, corporate bond rates have remained virtually unchanged and there are therefore no particular additional opportunities on the bond market at present. Similarly, there has been no particular change in bond hierarchies in terms of risk/return for three reasons:

- The issues at stake had already been the same for several months, including the economic slowdown, geopolitical tensions and inflation. As for the trade war launched by Mr. Trump, investors had been warned about it for several months, since his election at the end of 2024, which had allowed them to adjust their portfolios accordingly, for example by avoiding certain industrial sectors or those overly exposed to Sino-US trade.

- Interest rate and spread movements, linked to non-financial issues, affected all sectors almost indiscriminately, which did not create, as in 2020 or 2016, specific opportunities in certain market segments to the detriment of others.

- Finally, it should be noted that given the rates already embedded, between 3% and 6% on corporate bonds depending on their maturities and credit quality, spread movements of between 20 and 50 basis points depending on quality and maturity remain very moderate or even insignificant.

However, we believe that a recent market movement is significant and potentially attractive for European bond investors: the rise in the US/Euro yield spread to 200 basis points per annum, which on a 5- to 10-year investment can represent a major difference in final performance, coupled with the fall in the dollar, making this type of investment even more attractive from a European perspective.

Why such a move?

Some countries, such as Japan, China and other emerging countries, generally invest in foreign currencies, particularly the euro and the dollar, in order to diversify their reserves, regulate their own currency or gain bargaining power with other countries by being a significant creditor. When they make this type of investment, most of it is usually placed in treasury bills, which allows them to earn interest on their cash, hold an asset rather than simply fiat currency, and position themselves on the “least risky” asset in a region. China is thought to hold around $700 billion in US Treasury bonds, which may seem very modest given the US debt of $35 trillion, but still represents around 15% of bonds held by international investors and can therefore be arbitraged more quickly and easily than the reserves of the Fed or US institutional investors. Furthermore, in a context of market illiquidity, even moderate flows can create price distortions. We believe that political and geopolitical reactions, as well as moves towards greater diversification by certain major investors such as China, are likely to be behind this dual movement, which already occurred at times in 2017-2018 and represents a long-term trend towards China's disengagement from US debt. It should be noted that China held between 7% and 10% of US debt a decade ago, compared with only around 2.5% today.

For example, a Chinese state-owned bank wishing (or having been instructed) to sell some US positions to Europe in view of the ongoing trade conflict will sell its T-Bonds and then its dollars to buy euros and German Bunds.

This is what we believe has happened in recent weeks, in a context where no international investor wanted to take a position on the US given the vagueness of political rhetoric and policy directions.

Is this move logical in the long term and therefore potentially sustainable?

In the long term, we believe that:

- The issue of excessive debt and budget deficits is more or less the same in the US and Europe, with the difference that the US generally experiences longer periods of growth and therefore has greater potential for deleveraging than the eurozone. Furthermore, the complexity of having a single central bank for several countries in different, even opposing, situations makes the issue all the more intractable for the eurozone. In the long term, therefore, we can consider that, at best, the eurozone and the US are equivalent in terms of credit quality, but that the advantage lies with the US, which therefore argues in favor of T-Bonds.

- Generally, the strength of one currency against another comes from factors such as interest rates, inflation, growth, and the trade balance. Currently, interest rates are precisely 2% higher in the US than in Europe, with credit quality (see above) that we consider equivalent from an international perspective. A further weakening of the dollar against the euro would therefore mean less growth and/or less inflation and/or an unfavorable trade balance. Admittedly, inflation is higher in the US, but this is generally because growth and employment are more dynamic there, while the factors driving imported and therefore imported inflation are just as present in the eurozone as in the US, and even more so due to the eurozone's greater dependence on raw materials. As for the trade balance, there is no need for US multinationals and other GAFAM companies to benefit from a weaker exchange rate to carry out most of their exports, particularly in digital services, as their offerings have become indispensable to the eurozone, while the reverse is not really true. In this regard, the eurozone currently appears to be squeezed between the US and China, and we believe that, in the long term, the euro is likely to come under pressure from these two currencies.

- From the perspective of foreign investors in both regions, the appeal of T-Bonds and dollar holdings will return in both cases:

- In the event of major stress, the dollar would regain its status as a flight to quality of last resort, more so than the euro.

- If the US government's international relations normalize, the dollar would also regain its “respectability,” all for a yield 200bps higher than that of European bonds.

Thus, in the long term, we do not believe that such a yield spread between US and European bonds is compatible with a lasting and significant strengthening of the euro. Of course, there may be epiphenomena, and we would strongly advise against speculating on 10-year T-Bonds over the next few months. However, in the context of a long-term investment, we believe it makes sense, with a EUR/USD exchange rate of 1.15, to position ourselves in US bonds with this additional yield of 200bps. Thus, over a 10-year horizon, an investor will have accumulated 2% per year (i.e., approximately 22 additional coupon points), which would allow them to absorb a parity of 1.40 on the eurodollar without losing money, a level that we believe is very high and very safe given the current economic balances and outlook for both regions. In addition, this will provide additional diversification. However, we would caution investors to pay close attention to credit quality, as US companies are generally riskier in terms of leverage than their European counterparts, and economic and credit cycles are more violent and painful in the US. We therefore prefer to stick to very high-quality credit bonds, particularly government bonds, which are particularly well suited to this type of investment scenario, unless we simply want to discover the currency risk of investments already made in US assets.

Although we are primarily euro credit managers, this type of investment scenario is nevertheless a useful tool for diversification and volatility absorption in phases such as the one we are currently experiencing, provided that it is moderate in size. We have therefore recently uncovered 3% of the euro-dollar currency risk in our Octo Crédit Value portfolio, a position that could rise to between 5% and 10% if the yield premium increases or the dollar continues to weaken.