11 April 2025

But in the end, did yields rise or not? A look back at a tumultuous week for bonds.

After a week spent watching screens that looked more like Space Mountain than financial market monitors, and because this is not the time for grand strategic conjectures that will be rendered obsolete in a matter of hours, we will spend this week simply reviewing the situation in the bond asset class and providing a few guidelines, or should we say segment guidelines given the low level of visibility, for our bond management during this turbulent period.

- Yields

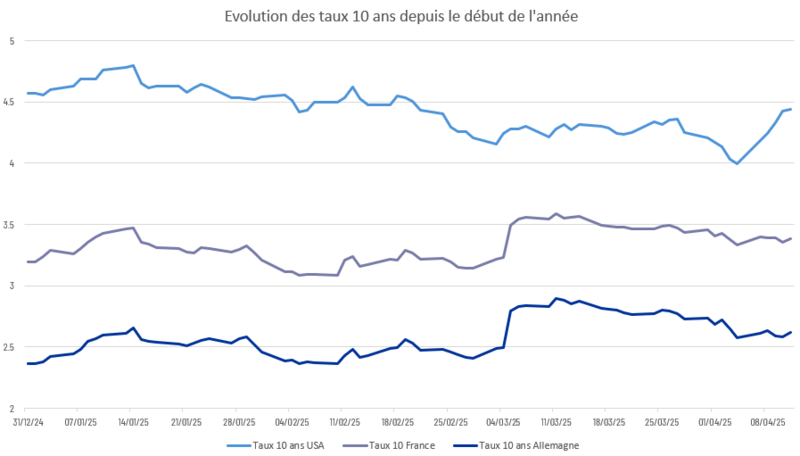

Nothing better than a few charts to illustrate this highly quantitative subject. We will note several points that tend to contradict conventional wisdom:

Sources: (Bloomberg, Octo AM)

- Over this period of a few days, sovereign yields ultimately changed little, whether in the US or Europe. For example, the US 10-year yield averaged 4.27% in March and stands at 4.32% today. Similarly, the 10-year Bund averaged 2.78% in March and currently stands at 2.74%, which is virtually unchanged.

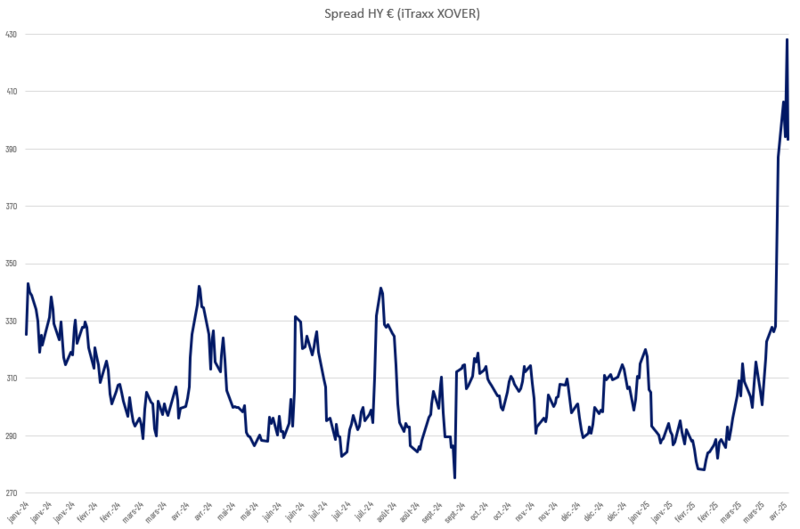

- Credit spreads have risen in line with the fall in equities, with a more pronounced increase in high yield, whose credit premium has widened by around 100 basis points on the indices (i.e., 1% more yield per year) between the March average and today.

Sources: (Bloomberg, Octo AM)

Could this be a first opportunity for bond investors?

Unfortunately, these periods of widening spreads and high volatility are almost always accompanied by a sharp deterioration in liquidity, as market makers are reluctant to take positions that could cost them dearly a few days or hours later. This 100-basis-point premium is therefore partly offset by the bid/ask spread, which could rise on some high-yield names to 4% instead of 0.8% to 1% in “standard” markets, thereby eliminating a large part of the premium.

Furthermore, it should be noted that credit spread indices (iTraxx) do not accurately reflect the behavior of the cash bond market and are often:

-

- More volatile, reacting minute by minute to developments in the equity market and news, than bond markets driven by longer-term flows.

- More concentrated, with significant differences between names in the index and others, as we have seen this week.

- Uncorrelated with the concept of liquidity mentioned above, even though this plays an important role in bond transactions.

- As a result, corporate bond yields ultimately changed little over the period, as shown in the following graphs and a few examples of bonds from various sectors.

- Are there any opportunities emerging on the bond market despite everything?

So far, the erratic movements linked to totally unpredictable political announcements and the fall in liquidity have probably made the fortune or misfortune of a few traders speculating on daily movements, but they have made portfolio reallocations too random, unprofitable and potentially too costly to seize for a long-term manager.

Therefore, unless you had a particularly risky position at the start of this stress phase, such as Chinese corporate bonds, an overly high weighting in the high-yield segment or excessive leverage, which were issues that needed to be addressed at almost any cost, we believe it was preferable not to change the balance of a bond portfolio during this week. For example, at Octo AM, we had been reducing our exposure to high yield for several months and, as of March 31, 2025, the most flexible portfolio in our range, Octo Crédit Value, had an average investment grade rating, which had not happened since 2019.

There was therefore no reason to reduce exposure or be concerned about such a stress phase. Similarly, we have believed for several months that long-term interest rates will come under upward pressure for several years and that each phase of volatility will tend to be short-lived. worry about such a stressful phase. Similarly, we have believed for several months that long-term interest rates will come under upward pressure for several years and that each phase of volatility will tend to accentuate this movement (despite short-term knee-jerk reactions) rather than slow it down. As such, our duration was also relatively short compared to bond indices. There is therefore no reason to change this already conservative positioning.

However, we have identified a few opportunities in specific bonds or special cases linked to technical phenomena or flows that could improve the portfolio's return and premium without changing the overall positioning and risk at all.

- Cross-currency arbitrage

Due to the size of the market, the shock of a few percentage points on the dollar and the significant outflows on the US high yield and subordinated financial markets last week, we saw an increase in yield spreads between the euro and the dollar for bonds with equivalent credit ratings and maturities. For example, we were able to replace a Santander 2030 subordinated bond we held in euros with another Santander bond with the same subordination at 5.90% in dollars, representing a 0.6% yield spread per annum net of currency hedging, acquired for the portfolio on this position without additional risk. In these difficult markets, this type of risk-free yield optimization allows us to improve the risk-adjusted performance profile of the portfolio relative to indices that focus solely on their benchmark currency in the medium term.

- Bonds experiencing rapid and significant discounts

While the illiquidity prevailing in these market phases is not conducive to arbitrage or portfolio reallocations, it may be conducive to opportunistic purchases if forced sellers emerge, particularly in the event of margin calls or fund redemptions. This week, we were able to find a few bonds whose yields we found particularly attractive, both from a historical perspective and in terms of risk/return. One example is a Scor hybrid bond denominated in US dollars offering a yield of 9.3% on the 2029 call with a BBB rating, or 7% net of currency hedging. Similarly, in the short-term high-yield segment, we were able to acquire the Thyssen Elevators 2028 bond, which has already been refinanced by another recently issued bond and is therefore likely to be redeemed soon, at a yield of 8. 5% on the July 2025 call, the highest yield for this bond since 2023, even though its risk has declined significantly since then.

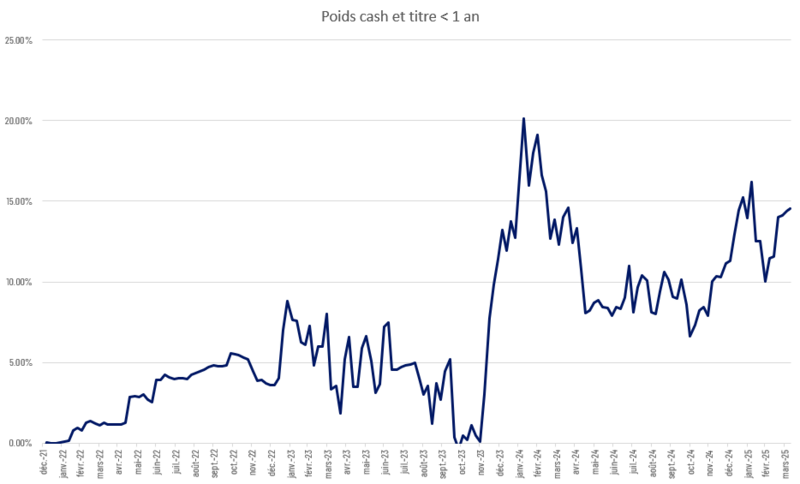

- Tactical cash management

Unlike an ETF or benchmark fund, cash and cash equivalents can be part of a flexible fund's strategy, especially when they are properly remunerated, which is currently the case. Thus, as the famous Liberty Day approached, considering that yields and spreads were, if not low, at least moderate, we gradually accumulated a 6% cash position, invested in money market instruments, which not only allows us to absorb some volatility but also to have “dry powder” or “dry powder,” as our Anglo-Saxon colleagues would say, to acquire a few issues at sharply falling prices without having to sell other bonds in poor market conditions and thereby impairing the final performance. This active cash management, which was virtually useless during the decade of negative interest rates, is currently highly appropriate in the context of a virtually flat yield curve and can be achieved in two ways: on the asset side through coupons or redemptions received, and on the liability side through good visibility of fund subscriptions/redemptions and therefore increased communication with investors, which is the purpose of this weekly report. For example, the chart below shows the cash flow of the Octo Crédit Value fund, which has grown steadily since the beginning of 2025 and has seen some reinvestments during the recent stress phase, taking advantage of one-off yield opportunities.

Source: (Octo AM)

- What is the outlook for credit and the bond segment in the coming weeks?

Over the next few weeks, we believe that volatility is set to continue and that announcements, negotiations and measures are likely to slow down or even completely freeze long-term investors. On the other hand, “fast money” will continue to come and go, giving the impression one day that everything should be sold and the next that everything should be bought. We would highlight four factors:

- Bonds currently offer significant carry, between 3% and 6% depending on credit quality, which greatly mitigates the effects of this volatility over a few months, especially for investors positioned in short or intermediate maturities.

- Mr. Trump's term in office and negotiations are only just beginning and are likely to continue for some time, as we saw during his first term in 2017. However, what causes the market to capitulate is not a one-off spike in volatility and uncertainty, but persistent volatility over a period of several weeks or months, which could happen in the coming months. We therefore prefer to invest very gradually as spreads and rates widen, rather than trying to read any signals of a market reversal or regime change. Thus, over the past week, yields have widened by around 50 basis points in the high-yield corporate credit segment, and we have added 2% to 3% to our weighting in this segment, which currently stands at 30% compared with a maximum of 65% in February 2022.

- Whether it be the ongoing negotiations in the US, various geopolitical tensions, the economic difficulties in the eurozone and its dependence on international imports, the scenario that currently prevails in our view is one of moderate stagflation, creating a dilemma for Western central banks on how to act on rates... Faced with this dilemma, they are likely to reach a soft consensus on key rates, for example around 2% in Europe, which is the inflation target, and a willingness to keep as many options open as possible for a potential return to quantitative easing by reducing the size of their balance sheets as much as possible.

- In the medium term, we believe that sovereign yields above 5 years will come under upward pressure due to government borrowing requirements, the deterioration in US and eurozone credit and geopolitical tensions. As with credit, we therefore believe it is preferable to maintain a short duration and increase it as spreads widen, considering that above a certain level, perhaps around 3.5% to 4% on the 10-year German Bund, the ECB would be forced to calm the situation and return to a more accommodative policy.

In conclusion, investors already positioned in a flexible or fixed-term bond fund with a maturity of 3 to 5 years should not be particularly concerned about the situation, but neither should they consider this a particularly favorable entry point for new investments or for significantly increasing their positions. The recent spread is around 50 basis points, or 10% of the current yield of a fund such as Octo Crédit Value or Octo Rendement 2029, and it is conceivable that increasing positions by the same amount could make sense, offering significant room for maneuver in the event of increased stress. For the rest, between cash on hand or proceeds from arbitrage at the expense of other asset classes, we currently prefer short-term, high-yield or flexible investments, which offer a significant carry of between 3% and 4% yield for very limited risk and volatility and a now significant premium over traditional cash products. Furthermore, we believe that this short-term segment is perfectly in line with our view of the current market, which is characterized by a relatively flat yield curve, rising credit risk, high volatility, and upward pressure on long-term rates.