21 March 2025

Markets swept away by excessive enthusiasm?

While Germany has indeed just ratified the expected constitutional change in budgetary philosophy, foreshadowing a recovery plan and an increase in debt focused on defence, the financial markets have reacted in two stages:

- An immediate rise in long-term rates, particularly German rates, for the obvious reason of the outlook for the supply of and demand for long-term sovereign bonds in the coming years and the gradual deterioration of German credit quality

- A wave of optimism for all risky assets, whether shares or credit spreads, particularly high yield, driven by the prospects of a potential increase in investment and growth in Europe.

We are somewhat surprised at how quickly the markets, in the space of just a few days, have disregarded the reasons for such a plan, namely an appalling economic and geopolitical context, and then anticipated the consequences of such a plan by several years by focusing only on the positive aspects.

We do not share this opinion and prefer to use what we consider to be an excess of optimism to secure our portfolios somewhat once again.

- It is far from certain that the German plan will benefit the whole of Europe: for more than a decade, we have seen Germany with dazzling economic figures while other countries struggled not to fall into recession.

- Nor is it certain that a recovery focused on defence and military spending will benefit other sectors of the economy in the medium term, especially if these military ‘investments’ were to be actually used, thus becoming ‘expenditures’. Can the construction of a military barrier to protect against a belligerent Russia be considered a productive investment?

- While private companies will really benefit from the German budget deficit to come, let's not forget that, for the Zone itself, it remains a zero-sum game since it is public deficits and therefore additional taxes to come for some households or companies that will feed other companies and other households in the ‘revived’ sectors...

- The rate hike of a few days that we have seen still does not seem sufficient in view of 1/ the current economic and budgetary balances of the Euro Zone, 2/ the heavy increase in the indebtedness of Germany, France and Italy to come, leading to an increase in the credit spread of the Zone, a fortiori on long maturities. This first rate hike was ‘epidermal’ but did not result from concrete market flows. To explain this, let us recall the opposite situation during the 2010s, the ECB's announcement of its willingness to use its ‘monetary bazooka’ and to make massive acquisitions of long government bonds and its implicit implications in terms of rate cuts. In the weeks that followed, rates fell rapidly by a few dozen basis points; then there was a continuous and much more powerful force of falling rates, thanks to the ECB's concrete bond purchases, which occurred over several years, gradually bringing long-term rates into negative territory, making the first post-announcement tightening by Mr Draghi almost anecdotal... This is what we think could happen in the opposite direction in the coming years, as the supply/demand imbalance of long European government bonds seems to us likely to increase between budget deficit, the knock-on effect of higher rates on rising indebtedness, household impoverishment, a decline in the confidence of international investors, a rise in the credit spread, low returns on investments made through the recovery plans, etc. There is therefore no urgent need to lengthen the durations and to position oneself on government bonds, and we consider that a 10-year German government bond rate of around 3.5% could be a perfectly feasible equilibrium point in the medium term, bringing the French rate above 4% - or even higher in the event of a run-up in credit spreads - and the Italian rate to 4.5%. It is only once these rates have been reached, growth has slowed sharply and systemic risk has become possible that the ECB seems to us to be able to intervene again through quantitative easing; this intervention would not be ‘free’ and would probably be accompanied by negotiations similar to those carried out with the peripheral countries between 2012 and 2014, as well as European integration solutions for financing or budgets.

- From the point of view of companies, let us not forget that before we see any concrete effects on the income statement or credit quality, we will first have to deal with increased government debt, higher taxes and increased investment and therefore increased risk for companies in order to respond to potential order books, which are likely to be concentrated in a few specific sectors.

We may resemble the Cassandras of the markets in this weekly report, but we would nevertheless like to point out in conclusion that a large number of ‘crossover’ and/or cyclical and/or opportunistic companies, with long-term experience in the credit markets and advised by their financing bank, have come to finance themselves on the bond market in recent weeks, taking advantage of the optimism to raise capital on current yields. This could suggest that these companies tend to agree with our point of view and prefer to borrow today because they think that their borrowing rate will deteriorate in the coming months.

Among these companies with a rather effective track record in terms of bond issues (i.e. issuing bonds at the most opportune time for them and therefore the least opportune for an investor...), we recognise in the Investment Grade universe a few companies with very limited financing needs and which are, as a result, very selective in terms of issuance niches:

- Air Liquide, which issued at 10 years at 3.57% for an A/A rating. Its last issue in euros was on 09/09/2022 at a yield of 3% for a maturity of 2032.

- Legrand, which issued at 10 years at 3.7% for an A- rating

- Delhaize, which issued at 8 years at 3.3% for a Baa1/BBB+ rating

- Honda, which issued at 4 and 7 years for respective yields of 3.33 and 3.98% for an A3/A- rating

- Ipsen, which issued at 7 years at 3.93% for a Baa3/BBB- rating

In High Yield, we would rather point out a few cyclical issuers, whose ratings and financing rates can vary greatly and who are sufficiently seasoned to finance themselves in a very opportunistic manner:

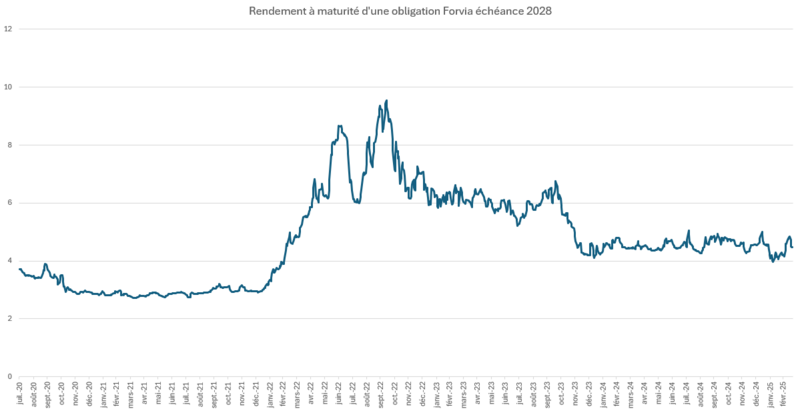

- Forvia (formerly Faurecia), which borrowed at a 5-year rate of 5.625%. We will make the link with our weekly report of 30 September 2022 on this issuer, which will serve as a reminder that the rate on Euro bonds at the time was above 10%. Moreover, in view of the company's historical average borrowing rate (see graph below), as well as the rather mediocre outlook for the automotive market, this week's primary issue is far from being an opportunity for a bond investor... It was more of an opportunity for the company, and it seized it.

Sources: (Bloomberg, Octo AM)

- Among comparable issuers that are cyclical, opportunistic and experienced in the bond markets, we would also note the primary issues of Sappi at 4.5% and a spread of 203bps over 7 years, Celanese at 5% and a spread of 250bps over 6 years, and RCI Banque in subordinated debt at 4.77% and a spread of 220bps over 12 years.

These levels seem low to us and therefore also to these companies with relatively rare issues and who are not in urgent need of refinancing.

In conclusion, we consider that investors have absorbed the rise in German indebtedness far too quickly and have only seen it through the prism of the few private companies likely to benefit from it, have too complacently assimilated the other countries of the Euro Zone to the German recovery plan, have over-anticipated the positive effects of such a plan without seeing the pitfalls, the trade-offs or the implementation time. We are surprised, in the face of such increased volatility and political, economic and geopolitical risk in recent months, to see such resilient valuations in the financial markets, in terms of bonds, credit and equities. We are therefore maintaining a relatively short duration, considering that rates will tend to rise in the coming months and years, and an increasingly cautious credit positioning, in terms of average leverage, sector and subordination. Given the still relatively flat curves and the small differences in credit premiums, this positioning nevertheless continues to offer significant returns on our portfolios, from 3.5% on the Octo Crédit Court Terme fund to 4.9% on our Octo Crédit Value or Octo Rendement 2029 funds, while hoping for lower volatility and various possibilities for reallocation in case of stress.