07 February 2025

Banks in the spotlight in this week's publications: financial bonds remain an opportunity in 2025

While volatility rose significantly this week in response to the US administration's first salvo of tariffs, the earnings season continued with a focus on banks, which confirmed our preferred positioning in this sector over the past few months.

It should be remembered here that, while we only had around fifteen percent of financial bonds at the start of 2023, because the opportunities and premiums on the High Yield segment were extremely attractive, their risk gradually increased and their premiums fell considerably, prompting us to reduce the credit risk in our portfolios and look for an alternative to the corporate High Yield segment. We felt that financials could play this role for three reasons:

- Yields close to those of high-yield BB for Tier 2 issues by intermediate banks

- A sector that benefits from higher interest rates, even though these tend to penalize other economic sectors.

- In Europe: regulator-driven risk management that benefits bond investors. We specify “In Europe” because the United States has opted for a policy of deregulation in the banking sector, which has largely benefited shareholders, but is less protective for creditors in terms of credit risk, notably due to exposure to financial markets and leverage.

This week, four leading banks have published their results: BPCE, Société Générale, BNP and Deutsche Bank. Although we don't have any of these four issuers in our portfolios, three of them seem to be too closely linked to the 'France' risk, which we'd like to avoid at the moment, and one because it's subject to too many uncertainties in terms of market risk or recurring litigation, All this for yields rather in line with those of other European banks, which are nonetheless representative of the European banking sector in terms of their size and their global, often pan-European positioning.

Three trends can therefore be observed in these results, confirming that the banking sector is in good shape and should see its credit ratios improve in the months ahead, unlike many other sectors, which have been adversely affected by higher interest rates, falling consumer spending or sluggish international trade:

- A rise in net banking income: +11% over the year for SG, +5% for BPCE, +12% for Crédit Agricole, +8% for Deutsche Bank

- An increase in net income: +69% for Société Générale, +140% for BPCE, +34% for Crédit Agricole. On this subject, we would like to emphasize once again that we have not taken positions on banks with excessive market or litigation risks, and the examples of Deutsche Bank and RBI have confirmed this choice: DB's earnings came to just €300m, compared with €1. 4 billion last year, despite an increase in NBI, due to legal provisions for Postbank and its Swiss franc-denominated mortgages... Excessive exposure to risky countries should also be a brake on bond investment, and the example of RBI (Austria) with Russia is quite telling, as the bank has been struggling since 2022 and once again this year showed alarming results, with a deficit of almost one billion euros on sales of 2 billion euros...

- Stable or rising solvency ratios, which are the guarantors of a bank's solidity: the CET1 ratio is often mentioned as a benchmark, and it rose from 13.1 to 13.3% at SG, while remaining stable at the other banks mentioned.

The results for the banking sector are therefore rather good, apart from a few special cases that we have often advised against, such as Deutsche Bank or banks with too strong a link to corporate and investment banking, particularly in the US. However, mere quality is not enough to be an investment opportunity if it must be paid for at a high price, offering bond investors only low yields. For several months now, we have therefore preferred to take position on Southern European banks to the detriment of the above-mentioned banks, despite their qualities, for three reasons:

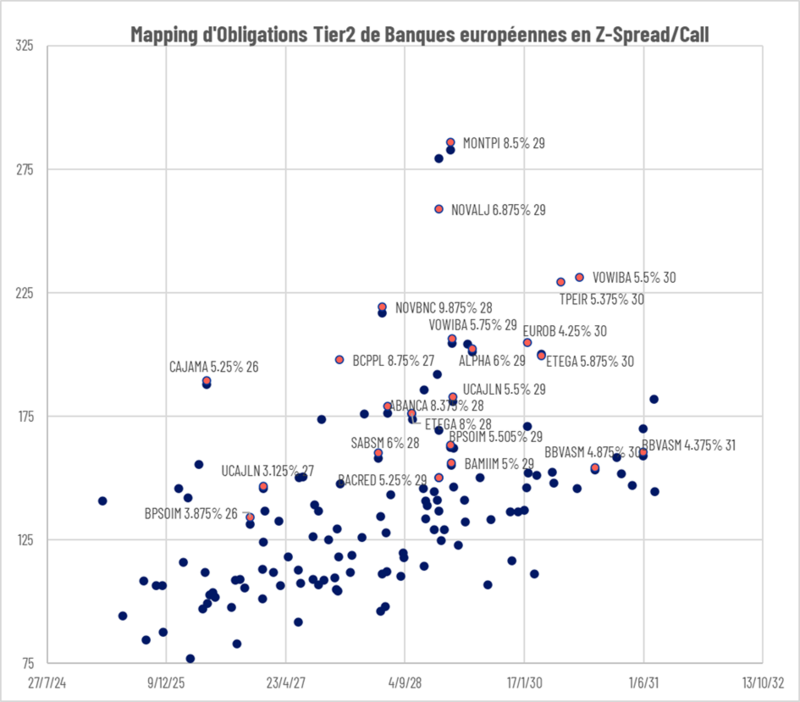

- A lack of brand awareness due to history, to structures that are often mutualist and to sizes that are sometimes more modest due to consolidation cycles that are still in their infancy, which makes it possible to offer significant yield premiums (see graph below).

- Strong improvement in credit ratios over the last few years, particularly in terms of bad debt levels (and therefore balance sheet quality).

- The most favorable geographic region in terms of trends for the months and years ahead between growth and relative fiscal balance. Given the pro-cyclical nature of banks' business and income statements, we believe it is currently preferable to take positions in these countries than in French or German banks.

Here are a few examples of financial bonds that offer wide yield premiums compared to their peers, and that could, thanks to a rather favorable cycle between economic growth and sector consolidation, see their credit ratings improve, moving them into categories more suited to many investors.

- Banco Montepio 8.5% 12/06/2034 call 2029

- Nova Ljubljanska Banka 6.875% 24/01/2034 call 2029

- Piraeus Bank 5.375% 18/09/2035 call 2030

- Novo Banco 9.875% 01/12/2033 call 2028

- Banco de Crédito Social Cooperativo 5.25% 27/11/2031 call 2026

The premium we currently estimate at 50 to 100 basis points of yield per annum is aimed to decline, providing investors with a de facto added value of 1 to 5 points of performance, depending on maturity.