03 January 2025

Credit 3/rate 0... what about 2025?

This week we celebrated the start of a new year, which the entire Octo AM team wishes you bright from every point of view - personal, professional and spiritual. In this issue of our weekly, we'd like to offer you a quick summary the year 2024, which once again ended up contradicting the consensus, and a few additional directions for 2025, following on from the main convictions we put forward in previous comments.

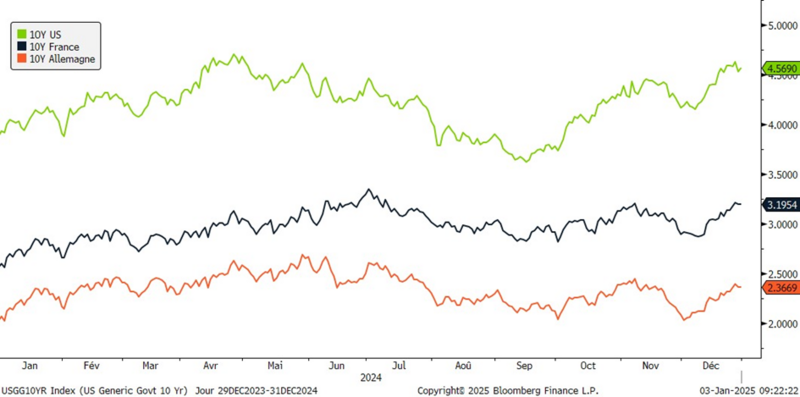

1. No, long rates have not fallen

As in 2023, in early 2024 we saw the emergence of two investment theses regarding interest rates: 1- central banks should cut their key rates quickly and drastically, and 2- the immediate link between short and long rates would lead to a fall in long-term yields. Prompted by these arguments, many investors, fearful of missing the train, positioned themselves on the long end of the curve. Once again, this year, this scenario did not prove to be very accurate, as none of the long-term benchmark rates fell, with the German 10-year rate, increasing from 2.05% to 2.35%, the French 10Y-rate increasing from 2.6% to 3.2%, or the 10Y-US rate rising from 3.9% to 4.54%...

(Sources : Bloomberg, Octo AM)

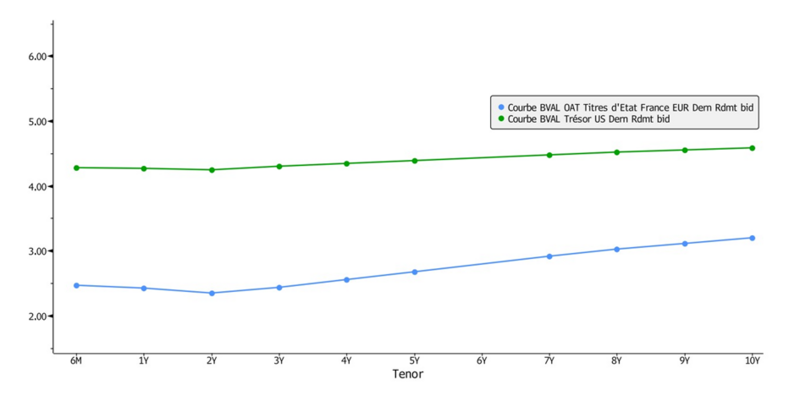

Although key rates did indeed decrease, this was due, quite logically after all, as we had defended it throughout the year, to the normalisation and re-establishment of yield curves we observed on both sides of the Atlantic.

(Sources : Bloomberg, Octo AM)

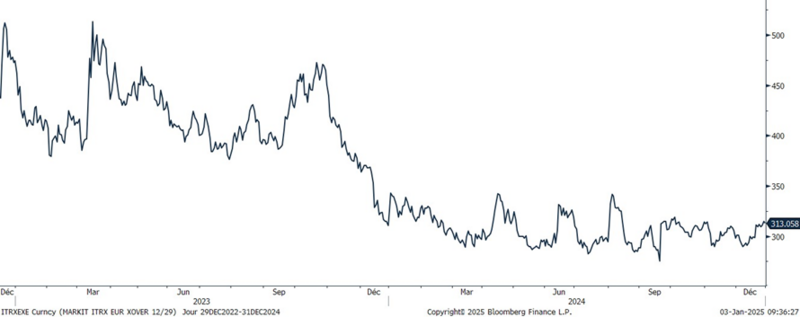

2. No, defaults have not exploded

At the beginning of 2024, one of the corollaries of the thesis of drastic cuts in key rates was a surge in corporate defaults, with central banks acting precisely to counteract a very sharp slowdown in economies, or systemic risks. But this was without considering the fact that business leaders are just as far-sighted, if not more so, than financial managers, and that they too know how to manage rising financing costs, economic slowdowns, political upheavals and other unforeseen events... So no, defaults have not exploded, and credit spreads have in fact narrowed significantly throughout the year, with companies borrowing at relatively tight levels compared with their benchmark sovereign rates, especially in countries like France, where political and budgetary risks have risen considerably in recent months.

(Sources : Bloomberg, Octo AM)

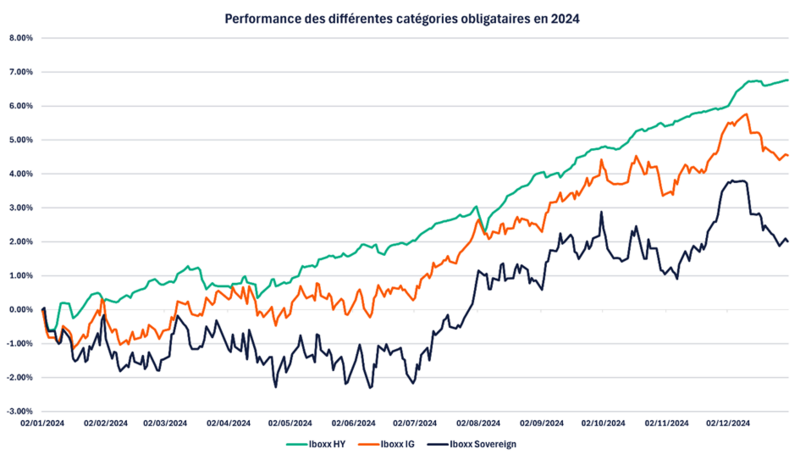

3. Once again, credit outperformed rates and high yield outperformed investment grade.

As in 2022 and 2023, bond classes with the greatest exposure to credit that performed best, thanks to their carry and lower sensitivity to interest rates and monetary and macroeconomic uncertainties. And the difference is significant: over a calendar year, an investor could cope with a performance differential of 4.75% depending on the bond category he chose... We often hear about bond ETFs, but one had to choose wisely the one to be invested in, and actively manage its exposure to HY at the expense of Sovereign & IG ETFs, contrary to the prevailing consensus...

(Sources : Bloomberg, Octo AM)

What about 2025?

While we have already underlined the need for prudence in our portfolios in recent comments, here are the themes we will be keeping a particularly close eye on in 2025, as we believe they could create performance differentials or major stress phases:

An increase in the free float of sovereign bonds

A major factor in the tightening of sovereign rates, particularly in Germany and France, during the era of quantitative easing was the low free float of sovereign bondsavailable to investors since a considerable amount was held by the ECB. We are currently experiencing the opposite phenomenon with Quantitative Tightening, which could be accentuated in 2025, all the more that bond issuance plans of all European countries remain high. By way of comparison, in mid-2024 the free float was 74% in the United States and 57% in the United Kingdom, but only 33% in Germany, according to IMF data. The gradual increase in the free float, which could reach 40% of German debt by the end of 2025, could de facto also increase volatility in interest rates. And the more European countries need to issue bonds in a backdrop defined by the willigness of the ECB to reduce its balance sheet, the faster the proportion of their bond float will rise... We will therefore be paying close attention to France, which we are still avoiding in our portfolios at the start of the year.

The increase in volatility on European sovereigns will therefore imply a great deal of flexibility on duration over the course of 2025, a fortiori with the still almost flat curve (and therefore not yet sufficiently normalised) that we are currently experiencing.

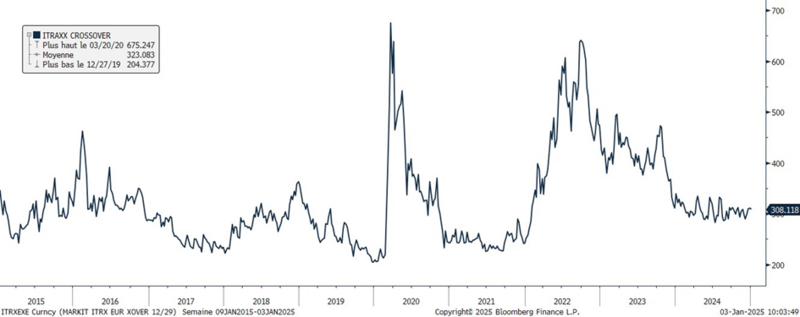

Credit stress

As in 2023, 2024 offered high yield a significant performance surplus compared with the more secure bond categories. Since 2022, high yield has outperformed European government bonds by more than 19.05%, and high yield has outperformed investment grade by 11.50%. We have largely defended high yield since 2022, for two reasons:

- Because the risk/return ratio was largely favourable in terms of expected performance

- Because credit spreads and absolute yields enabled it to absorb virtually all possible stress episodes.

While we still consider high yield to be a favourable bond category in relative terms, as it still provides an additional spread, it is no longer exempt from stress, as credit spreads have returned to their tightest levels. It would be quite possible to see credit spreads jump to 400 or 500 basis points (compared with 300 today) over the course of the year, creating phases of significant potential capital losses in the short term (only) since these will be made up in a few months by the carry, or attractive entry points depending on an investor's initial positioning...

(Sources : Bloomberg, Octo AM)

In terms of management, we have significantly reduced the high-yield exposure in our portfolios and hedged part of our positions against market risk, retaining only the yield premium associated with our value positionning. As with duration, we will actively manage our credit exposure throughout the year, in contrast to a our structrual exposure over the past two years.

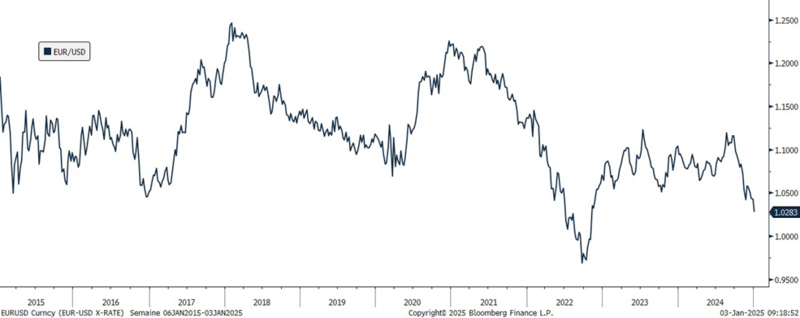

Weakness of the Euro

The economic, budgetary, political, and monetary dynamics of the USA and the Eurozone appear to be repeating a pattern similar to what we observed in the 2010s, albeit with even greater disparities, as the 15-year differential has progressively widened. We may see significantly higher key rates in the USA compared to Europe, which could result in the euro continuing to weaken against the dollar. The political and budgetary challenges faced by certain Eurozone countries, particularly the struggling French economy, could exacerbate this trend.

It may therefore be advantageous for bond investors to capitalize on the carry, which is already much higher in Europe than in the USA, while maintaining some unhedged currency risk. Similarly, emerging markets, due to their generally healthier fiscal positions and trade balances compared to the Eurozone, and their issuance in dollars or local currencies expected to appreciate in the long term, can offer diversification opportunities without currency hedging.

(Sources : Bloomberg, Octo AM)

Stagflation

A weak euro and a large trade deficit could lead to a significant rebound in inflation within the Eurozone, against a backdrop of persistent economic gloom, particularly in Germany and France, the two pillars of the region. The risk of stagflation is therefore becoming substantial in Europe, which could severely impact all risky assets.

In such a scenario, the ECB would face the challenge of being trapped between two conflicting needs: lowering interest rates to mitigate the risk of a deep recession and maintaining high rates to control inflation. This dilemma may persist for decades, as the gradual economic weakening of the Eurozone in the face of global dynamics seems inevitable.

In such backdrop, we believe that a balanced bond allocation between high-yield and investment-grade securities is warranted. We also favour intermediate maturities, as their yield-to-volatility potential appears much more attractive in the event of a significant macroeconomic disruption that could adversely affect long-dated bonds.

European Government Budget Deficits and Credit

While long-term government bonds can decline due to excessive inflation or monetary and macroeconomic imbalances, they can also fall due to concerns over sovereign credit quality, as demonstrated by the peripheral countries crisis. In this regard, the cases of Germany, France, and Italy are particularly troubling:

- France and Italy: Both countries have failed to reduce their budget deficits over the past several years, despite relatively favourable conditions. Their fiscal trajectories now pose a serious threat to their credit quality.

- Germany: Historically, its trade and budget surpluses, coupled with economic dynamism, have helped offset many of the excesses of other Eurozone countries, particularly in the eyes of global investors. However, this era appears to be over. The Eurozone now risks a significant loss of creditworthiness among foreign investors, including emerging central banks that typically favour high-quality currencies. The euro aspired to become as dominant a reserve currency as the dollar. However, the past two years have revealed a marked decline in its credibility and global appeal, particularly since 2023, relative to the US dollar.